Change is inevitable. But the rapid pace of changes brought on by severe disruption has altered the way companies do business. This has led to significant shifts in the global supply chain that affect manufacturers from placing raw material orders all the way to the production floor.

After an initial rally in mid-2020, supplier lead times began to increase again at the beginning of January 2021. By Q3 of 2021, lead times had grown 2.5% higher than during the pandemic.

The “why” of supply chain disruptions is fully evident, but the “how” still needs to be tackled. Manufacturers are becoming more flexible and adaptable to ensure they can respond to supply chain challenges. While many are bringing production closer to home, others are deploying technology to better understand the performance of their operations.

To Buy or to Make

A recent shift in supply chain strategies has been driven by necessity. For years, Lean, JIT, and optimizing logistics in a global supply chain was the path many manufacturers followed. This path included purchasing raw materials and components and outsourcing key upstream and midstream production segments to third parties.

Disruption led to new strategies, including buffer stocks, reshoring, nearshoring, and other tactics. These new tactics require companies to re-examine their internal strategies.

For example, companies must decide whether to purchase locally, even if the material is more expensive. They must also choose whether outsourcing or insourcing makes sense for their business model. Many companies that have long outsourced some aspects of production have begun to look at returning to vertical integration to shore up their external and internal supply chains.

The Benefits of a More Local Supply Chain

There are several benefits for manufacturers in a more localized supply chain. The effects of distant disruptions like stuck cargo ships, high tariffs, and other factors can be muted by localization. Localizing also enables producers to better control lead times and respond faster to demand.

Re-evaluating the supply chain also means companies can look at whether the cost, benefits, and risks of outsourcing still make sense for them. Many companies are already shifting from long supply chain legs to shorter segments “nearshored” closer to the US.

The shift has produced significant supplier growth in Mexico at the expense of China and other Asian suppliers once considered a stable component of the global supply chain. These trends reduce lead times and remove the ocean transit component from the equation.

Other companies are seeking even bolder ways to reduce cost and reduce lead times. If lead times and distance mean parts and assemblies won’t arrive on time, vertical integration may be a more cost-effective solution in today’s market.

Accurate Data: The Foundation for Decision-Making

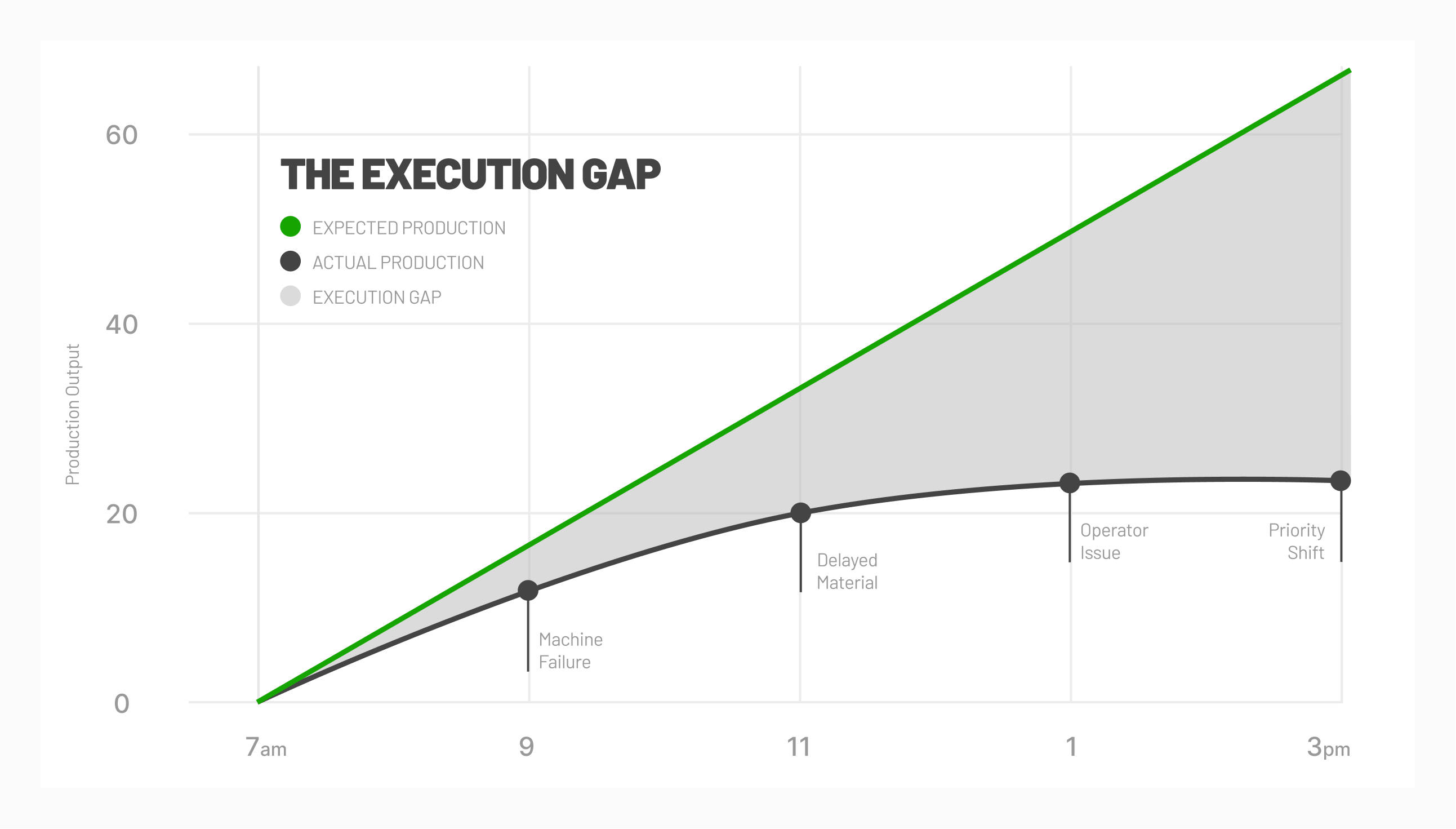

You first need to understand your production data to make an effective decision regarding your supply chain strategies. After all, you can’t decide how best to modify your external supply chain strategy “out there” if you don’t know the core data about your internal supply chain “in here.”

You can’t make the best supply chain decisions using flawed or incomplete data. If processes are inefficient and data is missing or in error, the decision to outsource or vertically integrate could be costly and run counter to what makes sense.

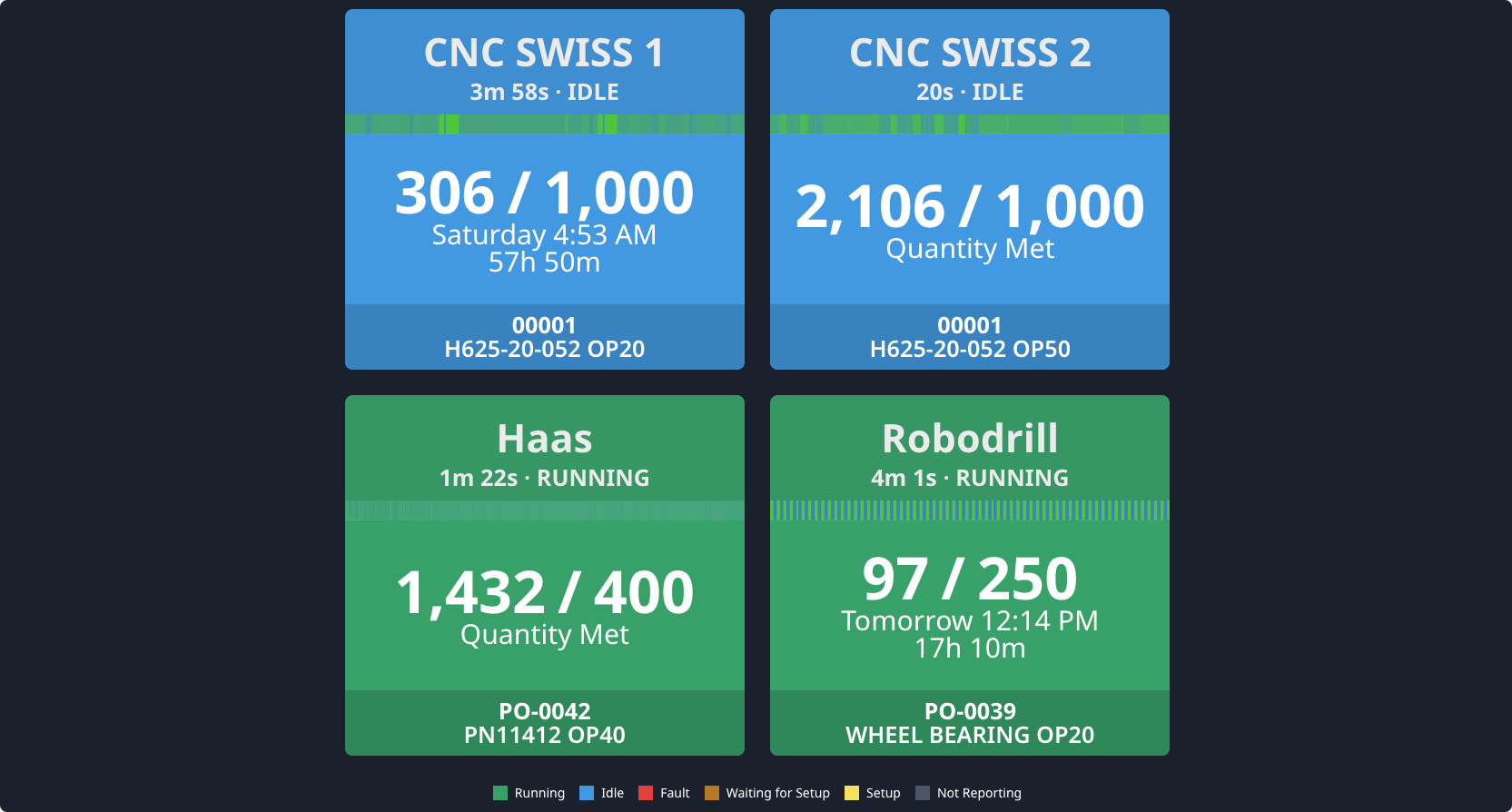

In fact, we have customers that have canceled machine orders simply after seeing their utilization data. Oftentimes, manufacturers have far greater capacity than meets the eye.

Manufacturers are leveraging your production data to optimize their internal supply chains, which is better preparing them for managing the external supply chain. Why? You can think of it as a closed-loop system.

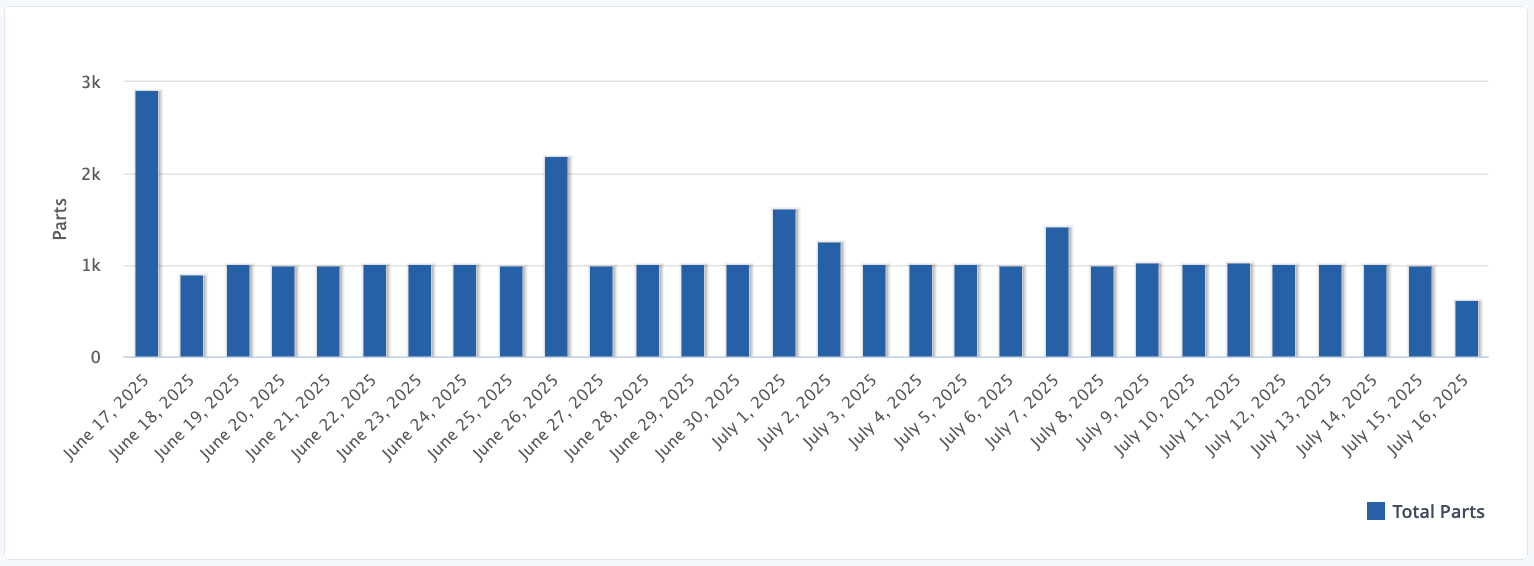

To know how many supplies you need to purchase, you need to know how much demand you have and how many components you are capable of manufacturing. Without accurate production data, it will be incredibly difficult to align production planning, demand forecasting, and execution.

The Role of Production Monitoring & Analytics

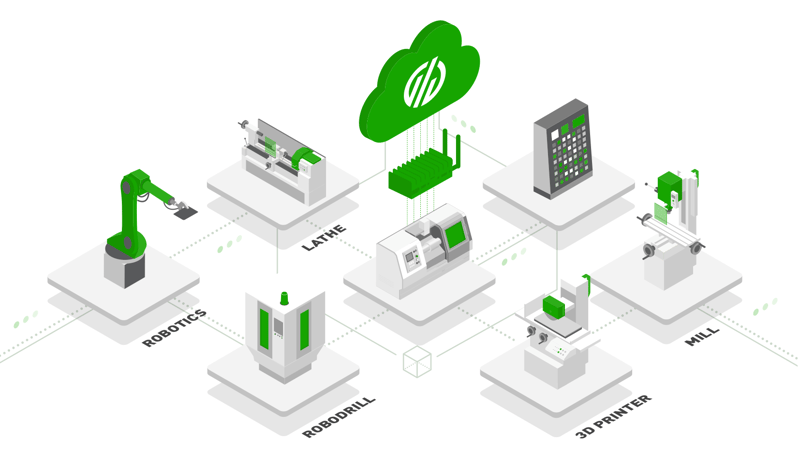

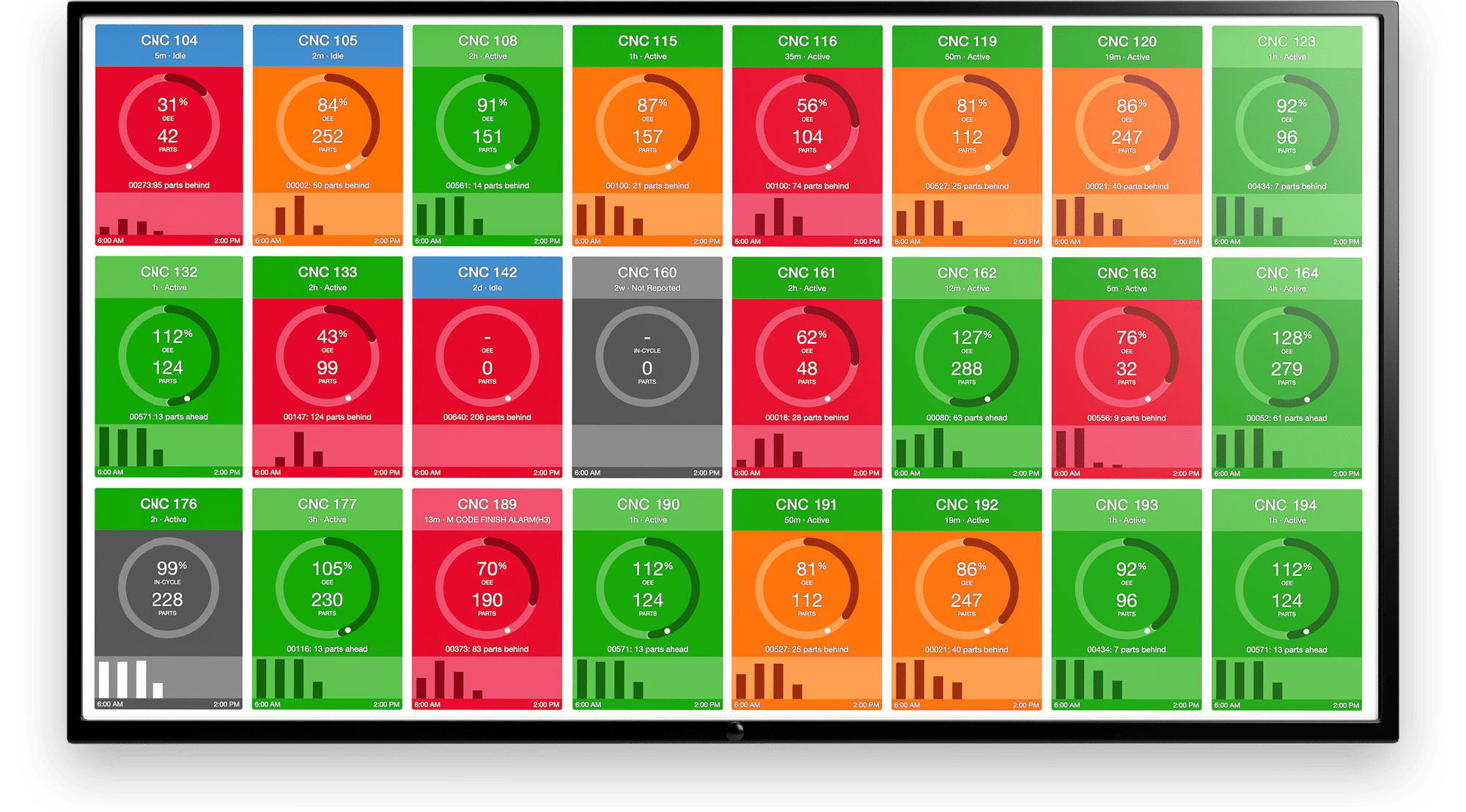

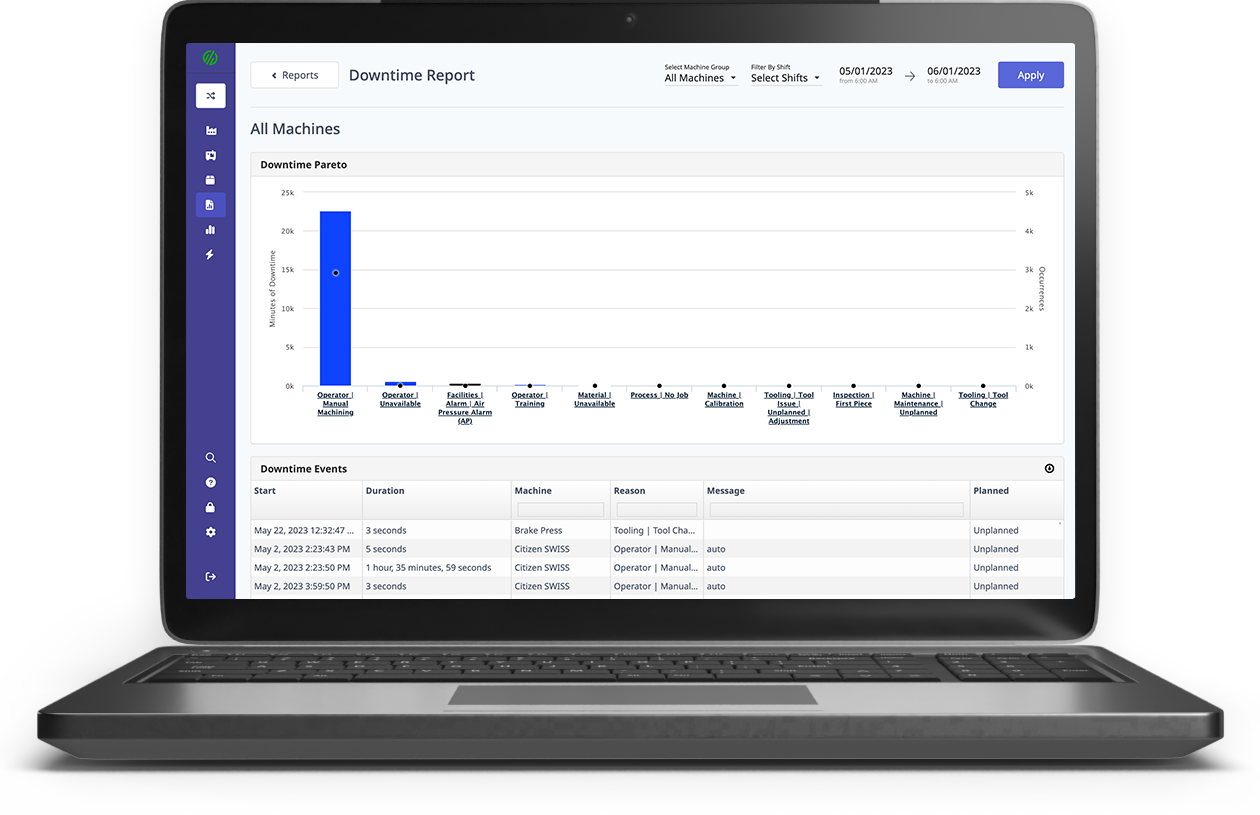

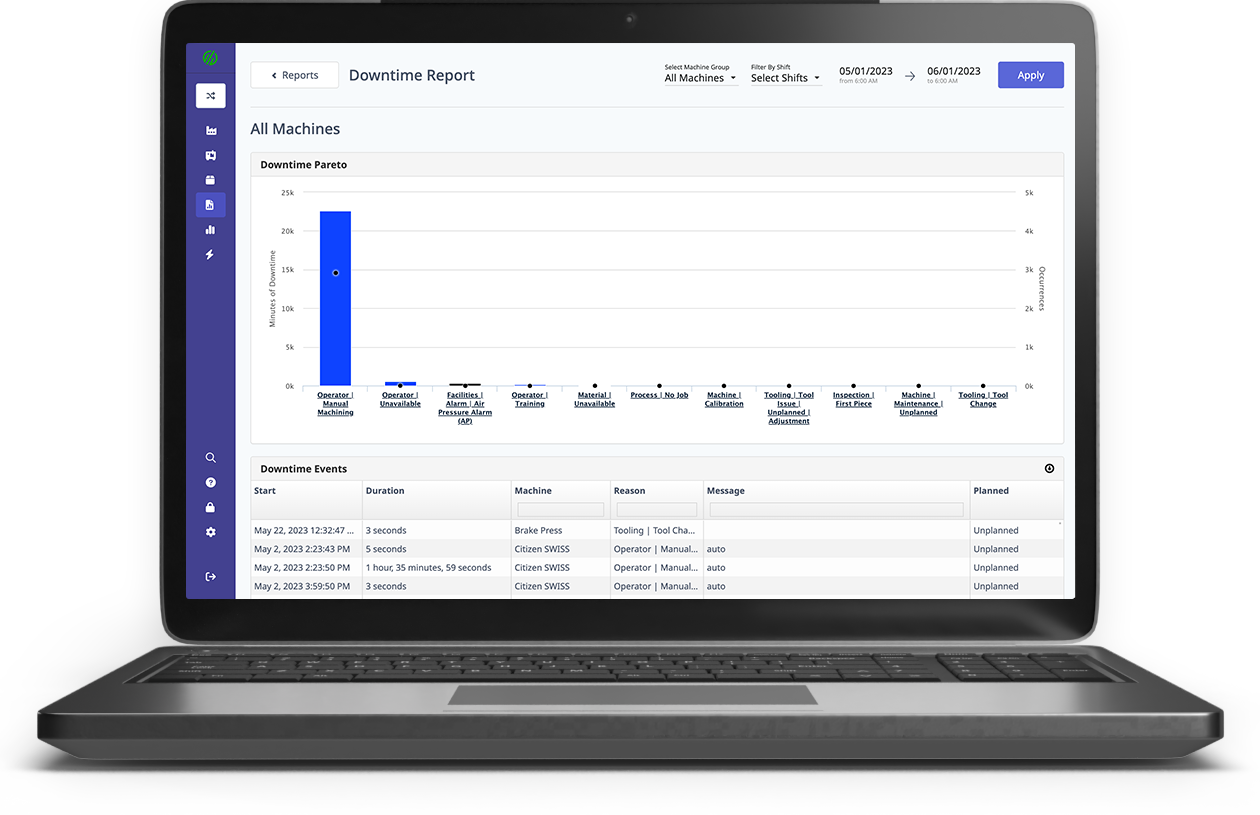

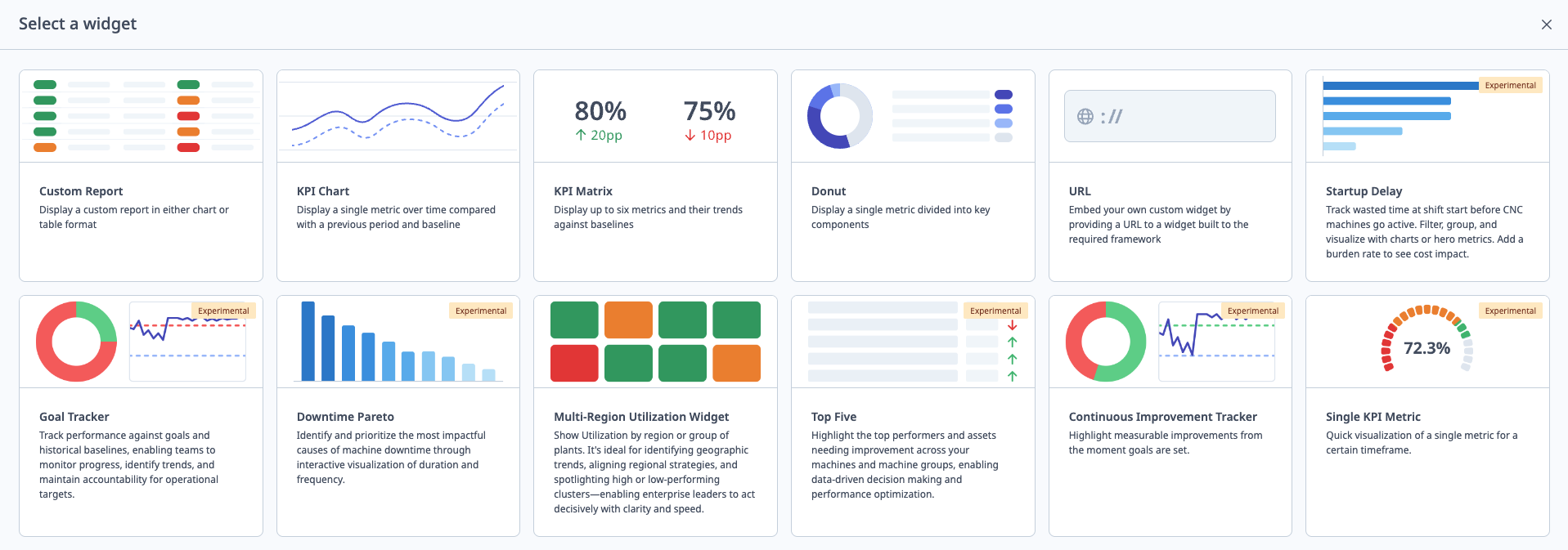

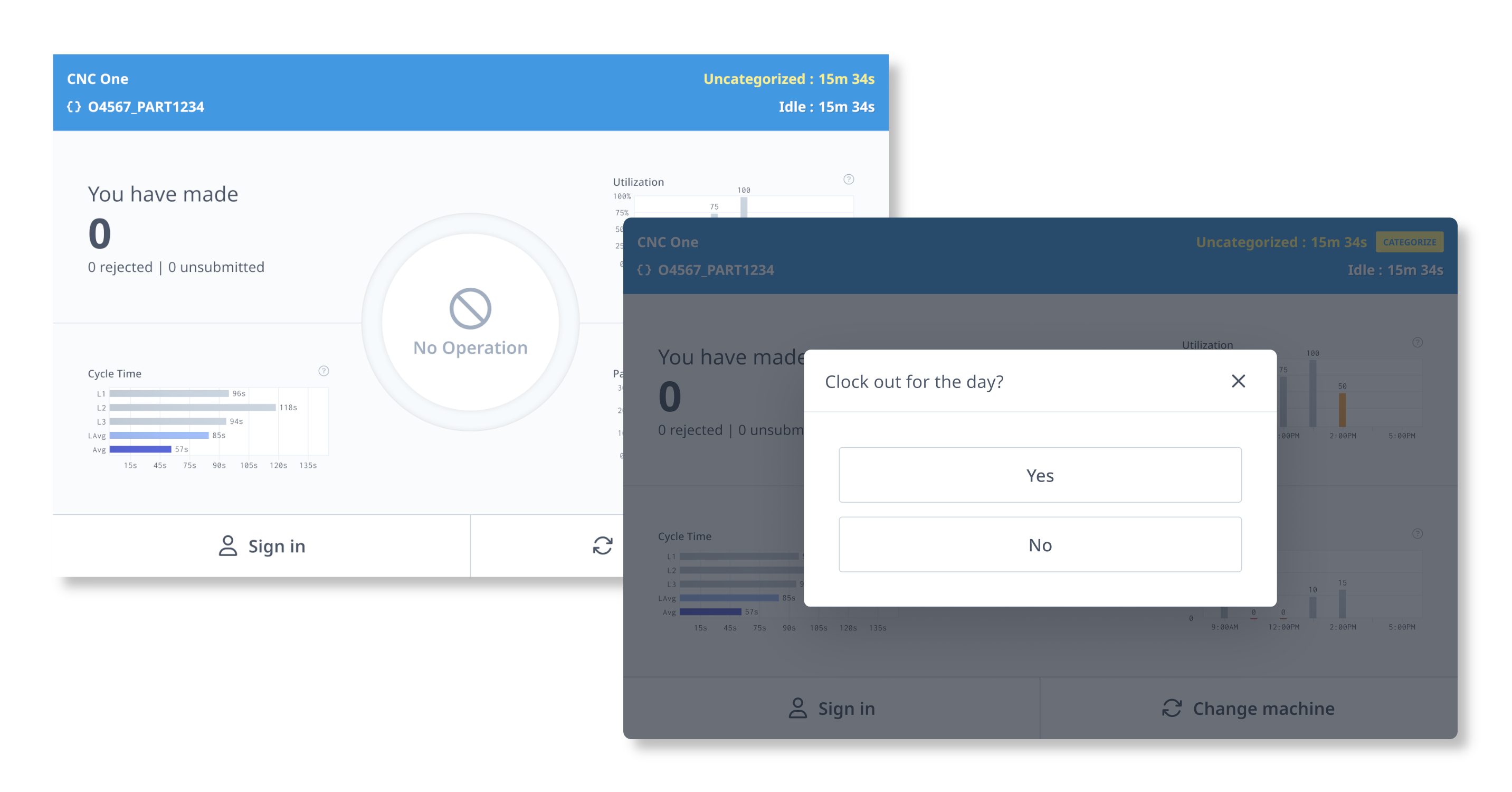

MachineMetrics enables you to capture real-time, accurate production data and ensure it is accessible to your team. This analysis holds the key to operationalizing real-time data and putting it to work to improve processes, change facility layouts, and significantly improve quality, inventory control, and equipment utilization.

Unsiloed data and analytical insights allow managers and operators to act, circumventing problems before they occur and using labor, materials, and equipment more efficiently. This data also provides a foundation for an informed decision on what supply chain optimization strategy works best.

For example, in a siloed or manual system with inaccurate data, managers may outsource production segments based on their limited visibility into the cost and impact on profitability. The real-time analysis of machine data across the enterprise could lead them to the opposite conclusion of vertical integration. The difference is in the amount and quality of data and the ability to analyze it in real time.

As processes become more efficient, the need for sending production to a third party can become cost prohibitive, which is a detail that may have been missed without using data.

Start With the Internal Supply Chain

Disruption will likely remain the norm for many years. MachineMetrics helps manufacturers capture enormous amounts of data and operationalize it to improve internal processes and supply chain. The jolt in efficiency and performance will point managers and decision-makers toward the best strategy for their external supply chain.

Most manufacturers have little insight into the status of their day-to-day operations, never mind the scale of complete supply chains.

Your analytics journey begins at the root of production, the machines and people on your shop floor.

Want to See the Platform in Action?

.png?width=1960&height=1300&name=01_comp_Downtime-%26-Quality_laptop%20(1).png)

Comments