A Bird's Eye View

As we round out Week 12 of quarantine, many of us are wondering — when will this be over? It’s looking more and more like the effects of coronavirus are here with us to stay, until an effective vaccine can be manufactured en-masse. As universities and labs continue to publish research on this new virus, it’s becoming increasingly clear to us that even though most cases are mild, the spread and severity of a novel contagion on the human population is still severe enough to make it a once-in-a-century crisis. Back during the Spanish Flu of 1918, as now, policy makers struggled to toe the line between public health and economic stability.

However, there are two big differences between now and then. The first is obvious — modern standards for medical care far outpace where they were a hundred years ago. The second, which is less obvious, but equally as important, is that we have more widespread and robust data collection methods. In just our industry - manufacturing - there has been an explosion of ways to get data of all sorts into the hands of decision makers.

We are entering a new paradigm of existence, one which is dictated by rapid shifts in both economic and health conditions; viruses operate in the realm of exponential growth, a concept which is hard for us to fully grasp. It is often confusing to try to assess the true impacts of exponential phenomenon with our natural instincts.

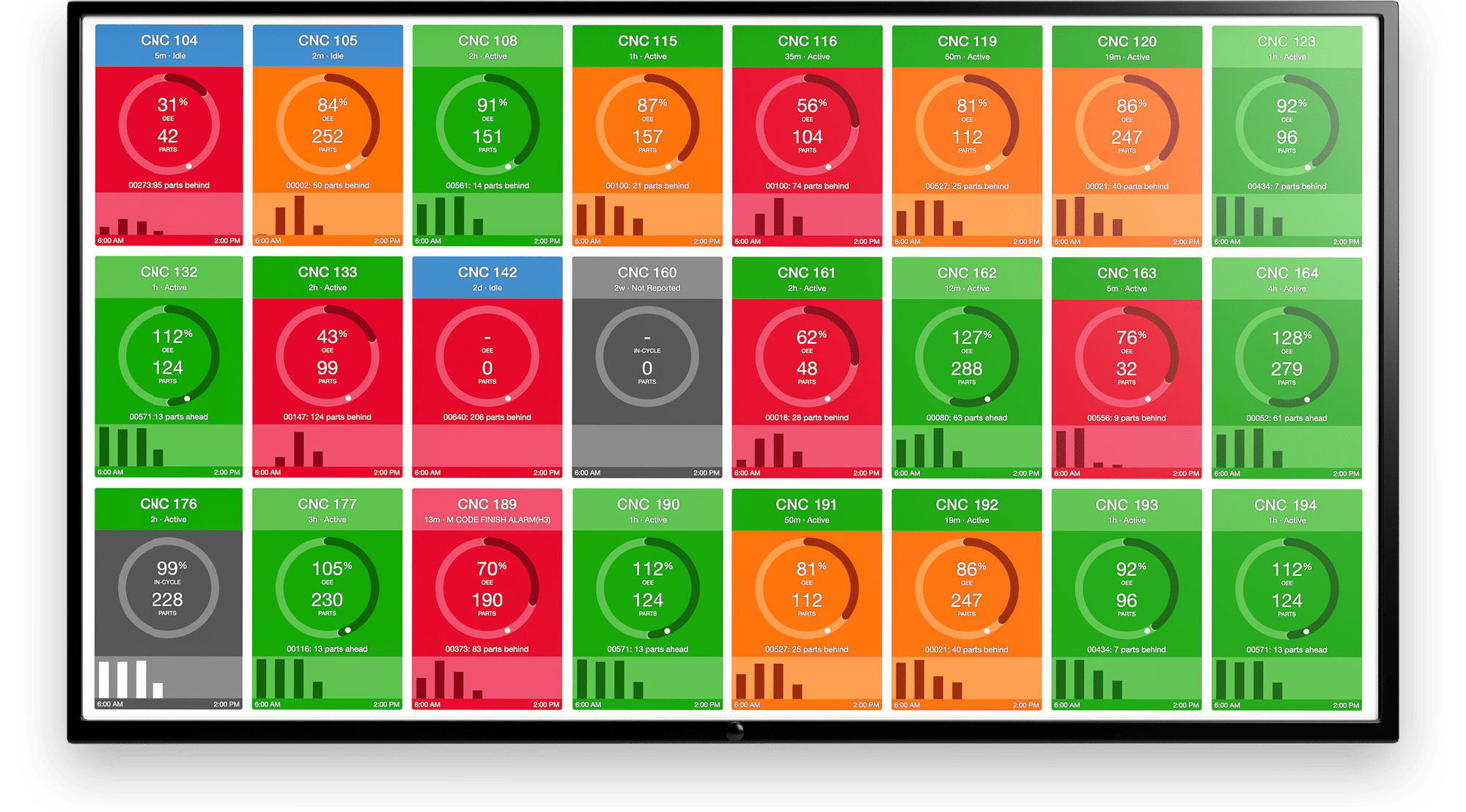

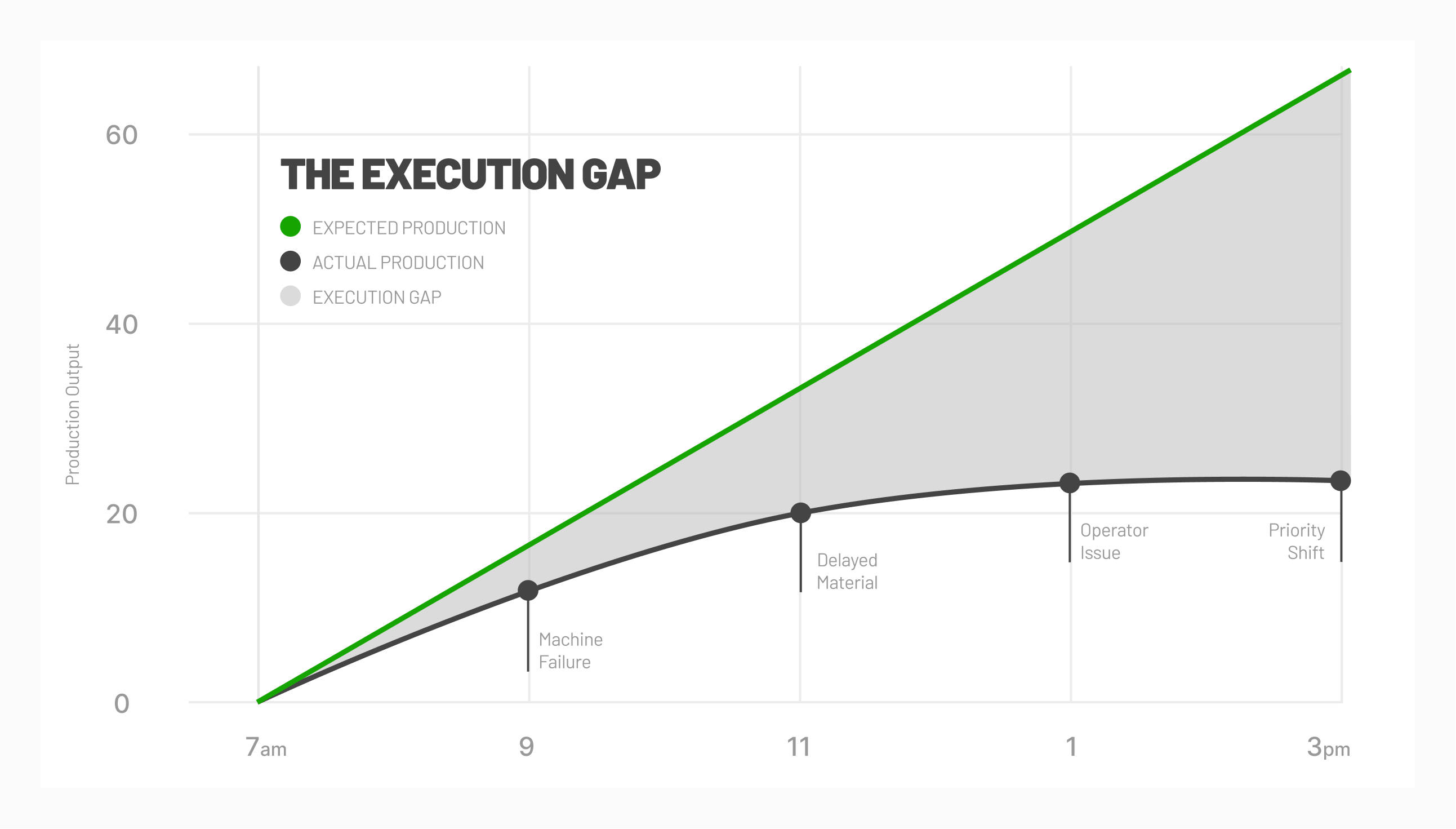

As such, data must be our friend and guiding force. Live, real-time updates on information and benchmarks become ever more important. Just like keeping an accurate pulse on case growth will be instrumental to balancing health and economic policy, keeping tabs on factory utilization will be key to assessing the state of our industry - the industry which will manufacture the necessary goods to help our world recover, stabilize, and continue to thrive in the future.

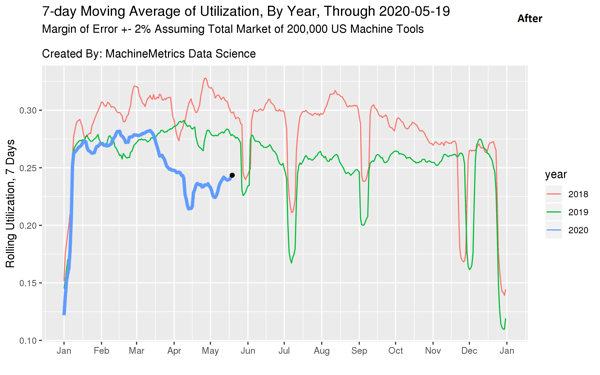

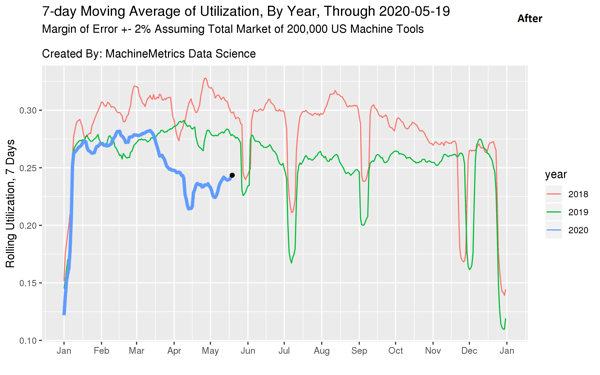

We at MachineMetrics are in a fortunate position to provide information to industry, policy experts, and consulting firms to allow a more accurate evaluation of the state of the industry. In just these last few weeks, we have been honored to be contacted by many organizations looking to incorporate our information into their forecasts and industry assessments. Because of this, we are continually improving our methodology and looking for ways to provide even more rigor behind our analyses. Recently, we have made several changes to our calculations and tweaked a few of our assumptions. These changes do not affect the overall conclusions or direction of utilization, but we feel it is important to be transparent around any changes we make.

Changes to Assumptions and Methodology

On May 21st, we revised some assumptions in our data set:

- Revision: Originally, companies with fewer than 4 machines in our data set were excluded from analysis. Now, companies with any number of machines are included.

- Reason: This was a carry-over from our industry benchmarking product, where current customers can see where they fall relative to others in the industry and receive a percentile score. Companies with <4 machines connected to MachineMetrics were not eligible for this product - but we feel that the exclusion is inappropriate for this type of analysis, as we wish to have as large a sample size as possible for aggregated industry trends.

- Effect: This change has expanded our sample size by ~5% and caused slight shifts in several time periods, most notably in Feb - May of 2019.

- Revision: Originally, machines that had disconnected from our software prior to 2020 were excluded from the analysis wholesale. Now, companies that disconnected in 2018 and 2019 are included.

- Reason: This was because these were considered “old machines”, but we realize the data they sent to us for 2018 and 2019 are still valid.

- Effect: Consequently, this has largely impacted 2018/2019 numbers and caused an expanded sample size for those years by ~10% and an upwards revision of utilization by ~8% for 2018. This has made the decrease from 2018 to 2019 seem more severe.

- Revision: Our customers can choose to be excluded from these types of analyses completely. We recently revamped a feature in our product which accidentally defaulted new customers to be excluded from benchmarking and data-aggregations. We fixed this bug and those customers are now being included in our data set.

- Reason: Bugfix.

- Effect: This has had a slight negative impact on 2020 numbers, with limited impacts to sample size and utilization within our margin of error.

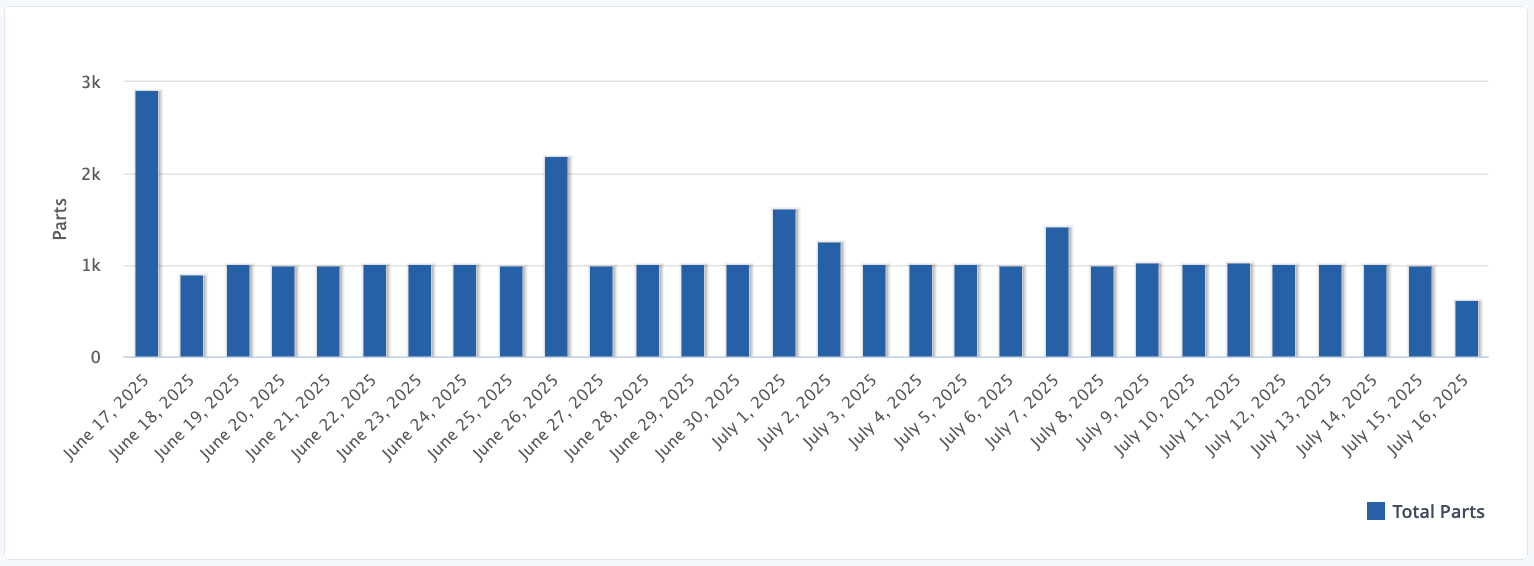

The aggregate effect of our changes is below. Our margin of error at 95% confidence, with the newly included machines, has changed from 2.24% to 2.08%.

Concluding Thoughts

As we emerge from shutdowns, it's important to keep in mind the power of data in enabling an accurate gauge of the state of our industry. We are just beginning to see the inklings of a steady, sustained uptick in utilization, a sign that manufacturing is returning again to a healthy cadence. We will continue to monitor and provide daily updates to all those who are interested.

The importance of using data cannot be understated when fighting an invisible foe — it must be an essential part of our arsenal, as it equips us with the necessary tools to respond with agility.

The importance of using data cannot be understated when fighting an invisible foe — it must be an essential part of our arsenal, as it equips us with the necessary tools to respond with agility.

We wish you well in these times, and please don’t hesitate to reach out with any questions.

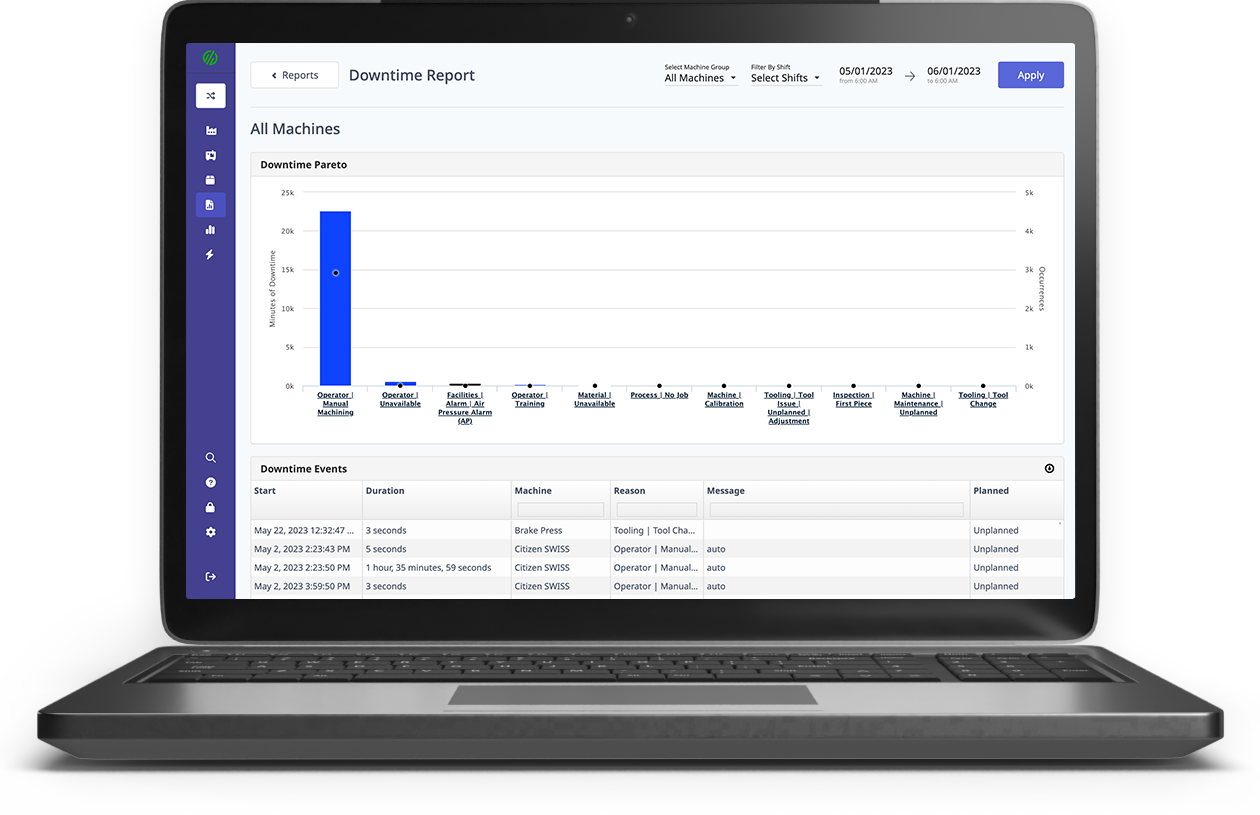

.png?width=1960&height=1300&name=01_comp_Downtime-%26-Quality_laptop%20(1).png)

The importance of using data cannot be understated when fighting an invisible foe — it must be an essential part of our arsenal, as it equips us with the necessary tools to respond with agility.

The importance of using data cannot be understated when fighting an invisible foe — it must be an essential part of our arsenal, as it equips us with the necessary tools to respond with agility.

Comments