An Update on What MachineMetrics is Doing

As the full impact of the coronavirus sets in, our daily updates to manufacturing utilization have become an ever more useful item in the toolkit of manufacturers and economists in gauging the true effects of the economic shutdown on manufacturing. The Wall Street Journal likens what policy makers are doing to putting the economy in a medically-induced coma and providing life support a la fiscal and monetary stimulus.

Even when in a coma, the economy, just like a person, must retain certain vital functions. A person’s autonomic and parasympathetic nervous system needs to still function, supported by various life-support machinery. And our society must retain certain vital functions as well, like feeding our people and providing support to the sick and infirm. You can see this in your daily routine - places that provide basic sustenance (grocery stores, farms, pharmacies) and life-preservation functions (hospitals) remain open, while virtually everything else remains shuttered and given a lifeline by state and federal government in the form of loans/grants to float them by during these trying times.

Companies that contribute to the supply chain for these vital products and services also remain open. Manufacturing constitutes the genesis of that supply chain - manufacturers create all physical products you see - including the ones that will get us out of this whole debacle. The manufacturing community and our customers have stepped up to the plate, re-tooling to produce ventilator components and other necessary medical devices, in addition to assuming workloads from companies in harder-hit areas with worker shortages.

We are proud to support both our customers during this time through providing our combined internal knowledge on manufacturing as consulting services, and even to our non-customers that contribute to this vital supply chain with free remote monitoring so they can spend more time with their families and loved ones, and still have visibility and control of their operations.

Recent Trends in Manufacturing

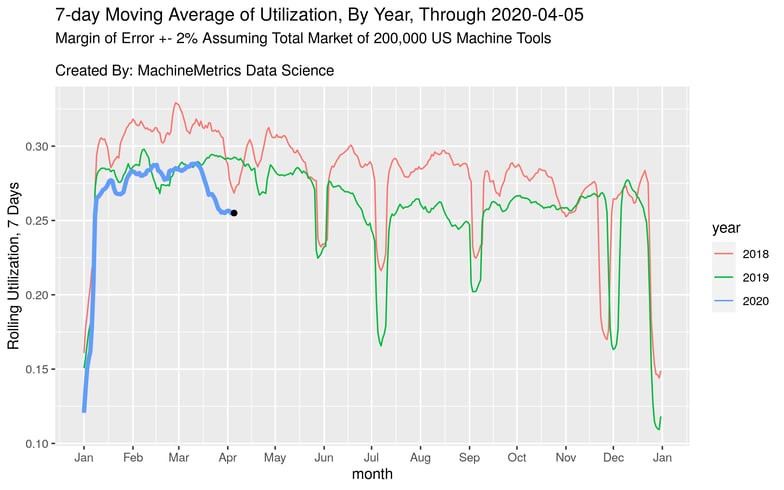

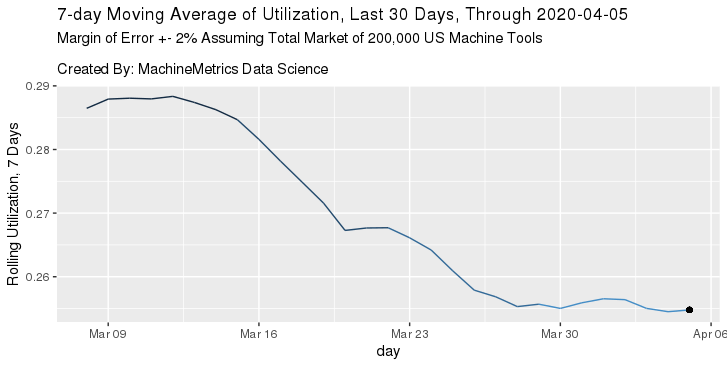

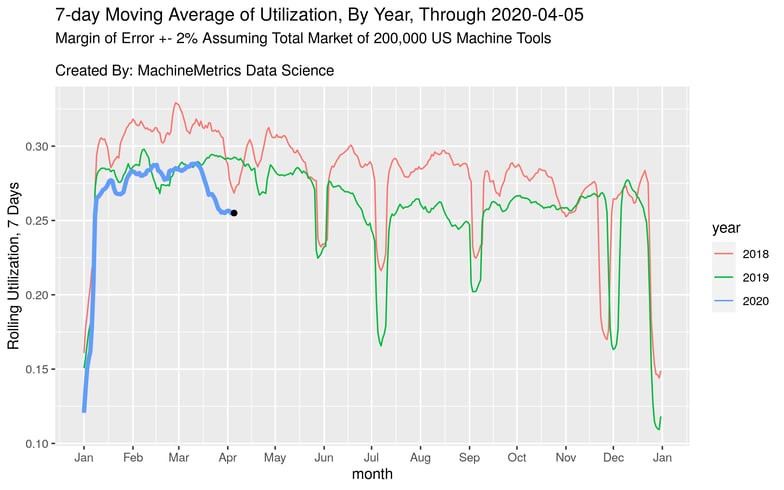

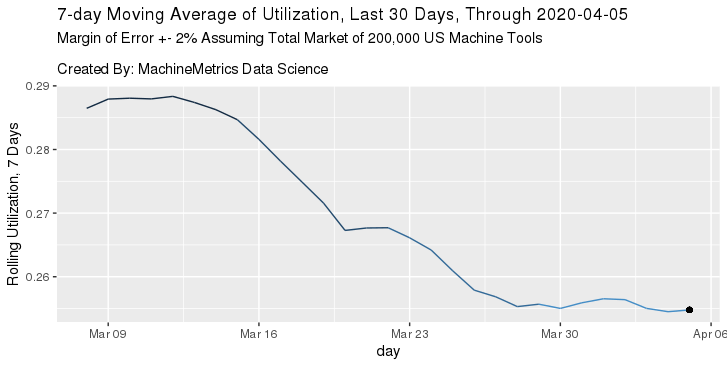

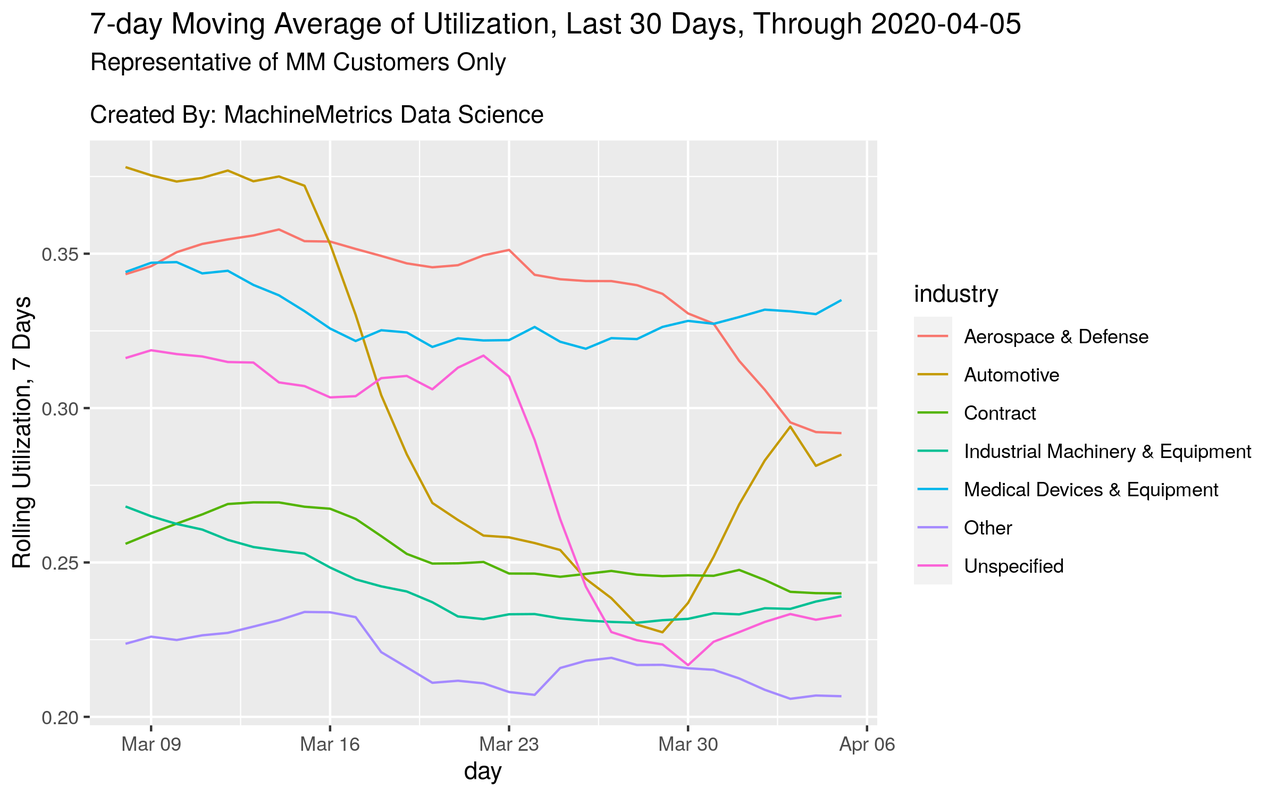

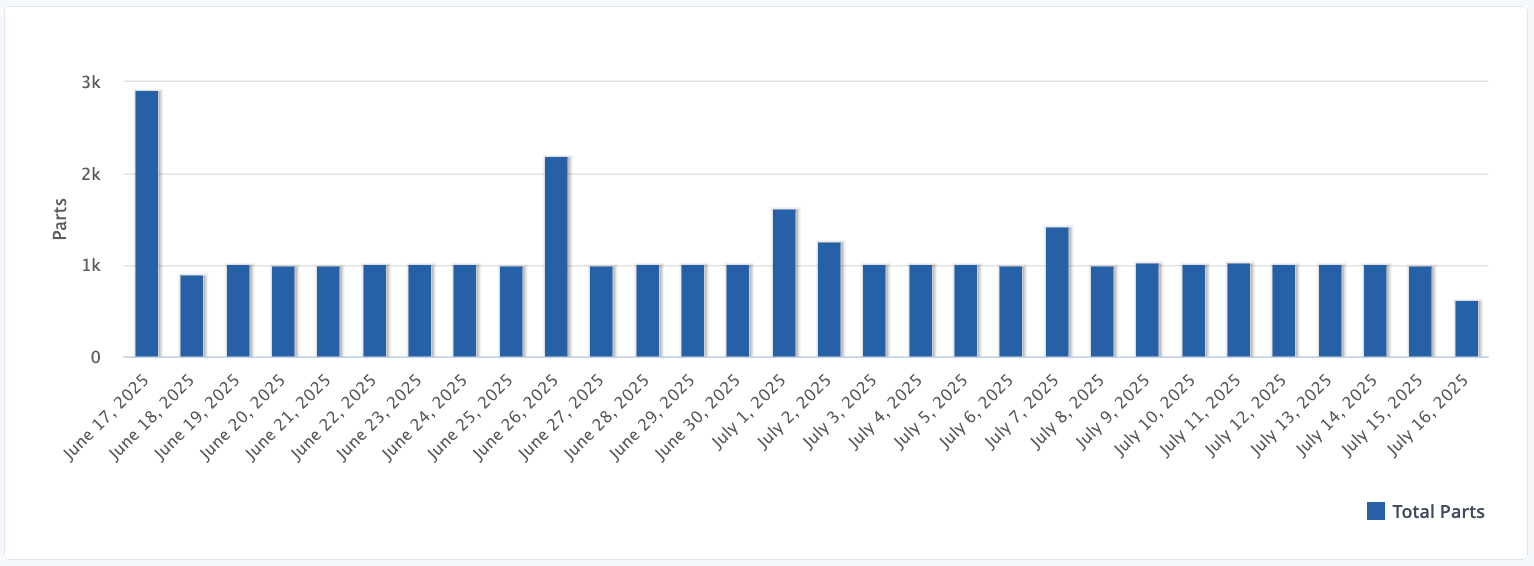

Since our last blog-update (March 21st), there have been several notable trends. Most importantly, the decline in utilization seems to have leveled off, for now, due largely to manufacturers re-tooling and responding to demand for necessary life-support equipment.

We saw a relative 17% decline, or ~5% absolute decline, in utilization during the month of March, from ~30% to ~25%. It appears as if a stabilization has occurred starting on March 28th. This is the day the US surpassed China as having the most coronavirus cases in the world, the House approved a $2 trillion dollar stimulus package, and hospitals really heightened their alarm for ventilators and PPE. These elements may have driven some manufacturers to choose to re-tool rather than shut down in the days leading up to the 28th.

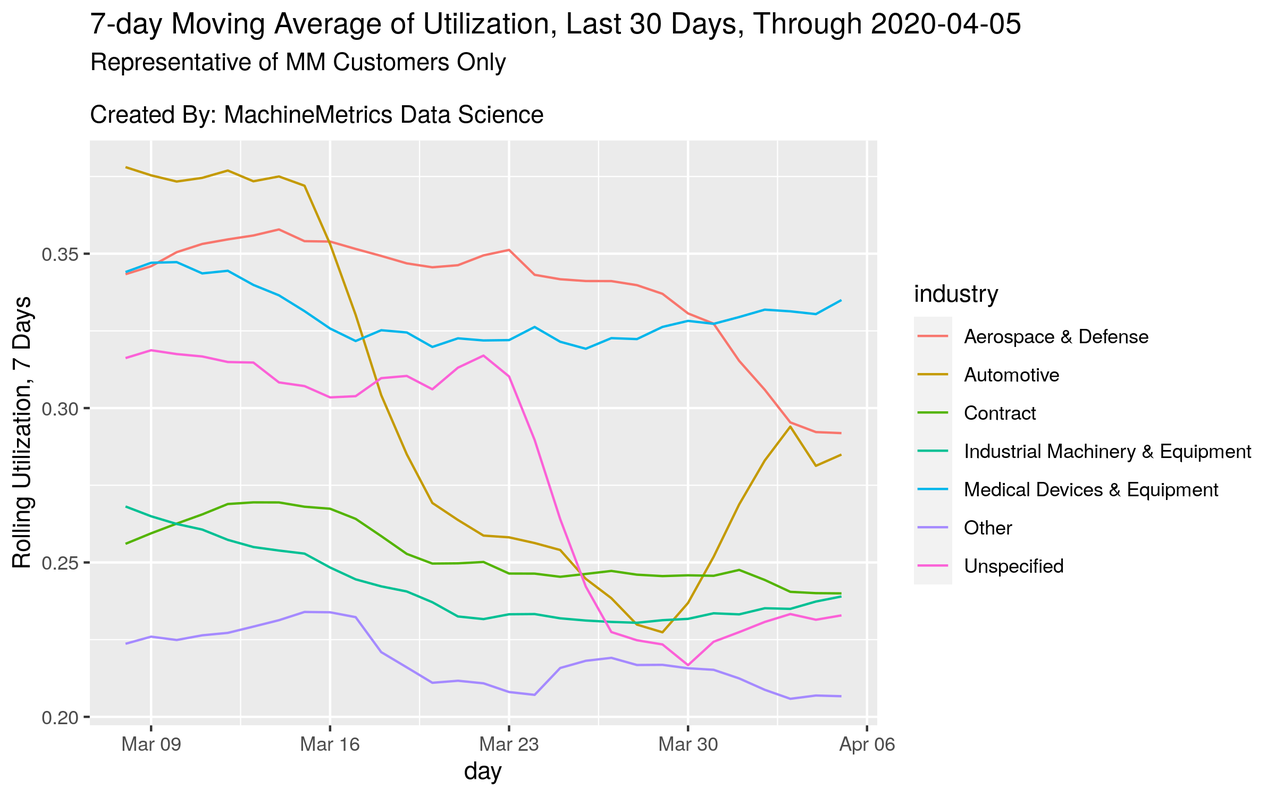

Digging deeper into this by industry, we validate the data corroborates our theory amongst our customer base. There was a marked increase in utilization from the Automotive segment and Industrial Machinery segment around the end of March, as they prepare to re-tool to manufacture medical components. This has partially offset the continued decrease we see in Aerospace & Defense, as Boeing and other major manufacturers continue to struggle. Medical device manufacturing, unsurprisingly, continues to rise and is now our highest-utilization industry as of March 31st, historically being in 3rd place.

Note that industry breakdowns do not have large enough sample size per vertical to claim this reflects broader industry trends. We merely claim these trends hold true for MachineMetrics customers.

A Note on our Methodology

As our insights have gained more attention over the past few weeks, we realize we are in a unique position to provide live-updates for broadly interested audiences on trends in manufacturing. As such, we have also received many inquiries on our methodology and our data sources. I will attempt to provide a brief answer to those here.

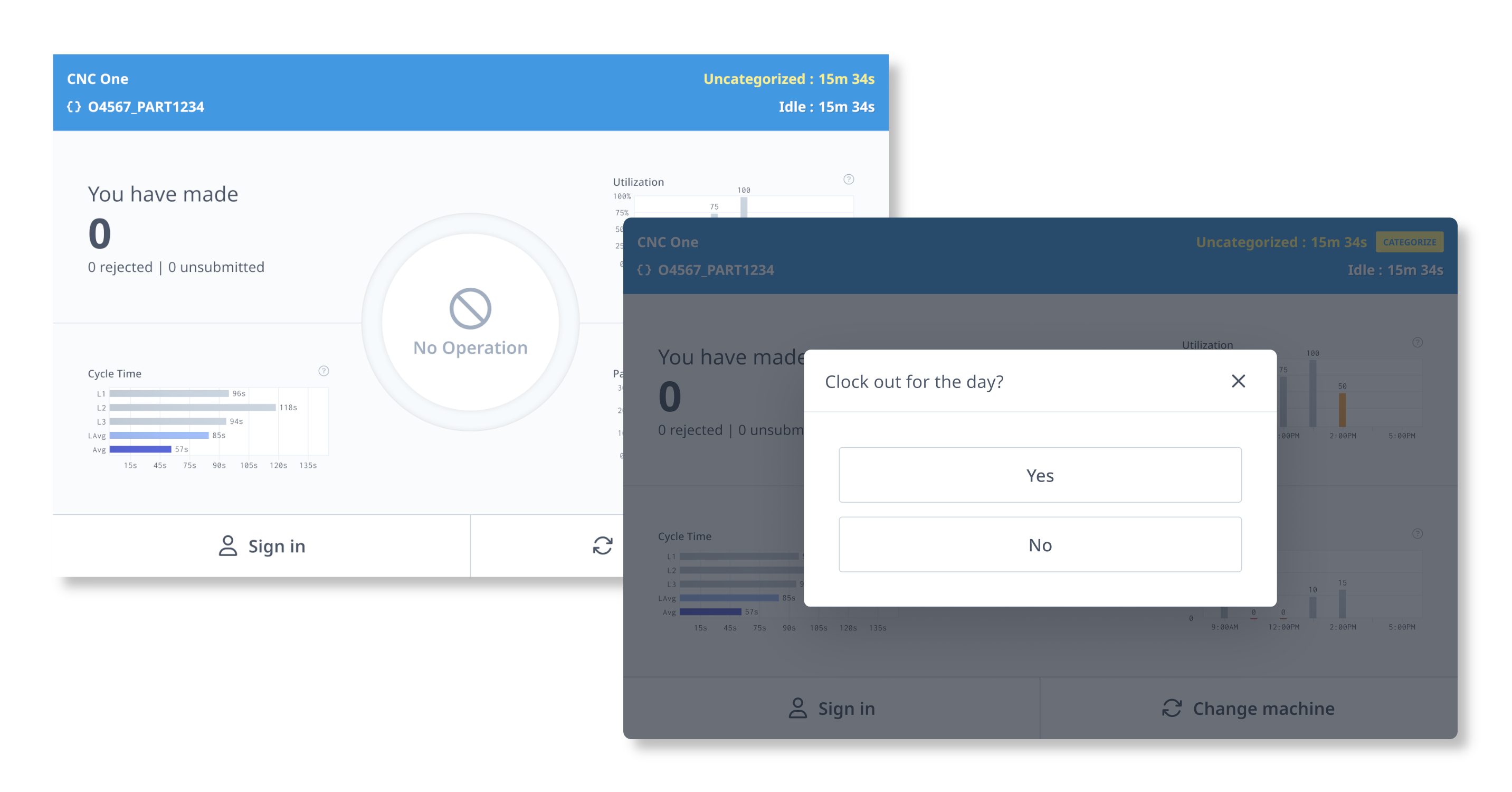

- How do you get your data? MachineMetrics is a cloud-only solution that connects directly to the PLC (programmable logic control) of the machine through an Ethernet/Wi-Fi/Cellular connection, or for older machines, with CTs (Current Transducers) that wrap around the main or spindle power cable of your machine to detect when electricity is being drawn for machining. We have spent a large majority of our effort the last few years developing adapters that can make this a plug-and-play experience for the customer, allowing us to mail most of our customers an edge device that they can install themselves, which can automatically sense, clean, and pull key data items from the controller once it’s hooked up.

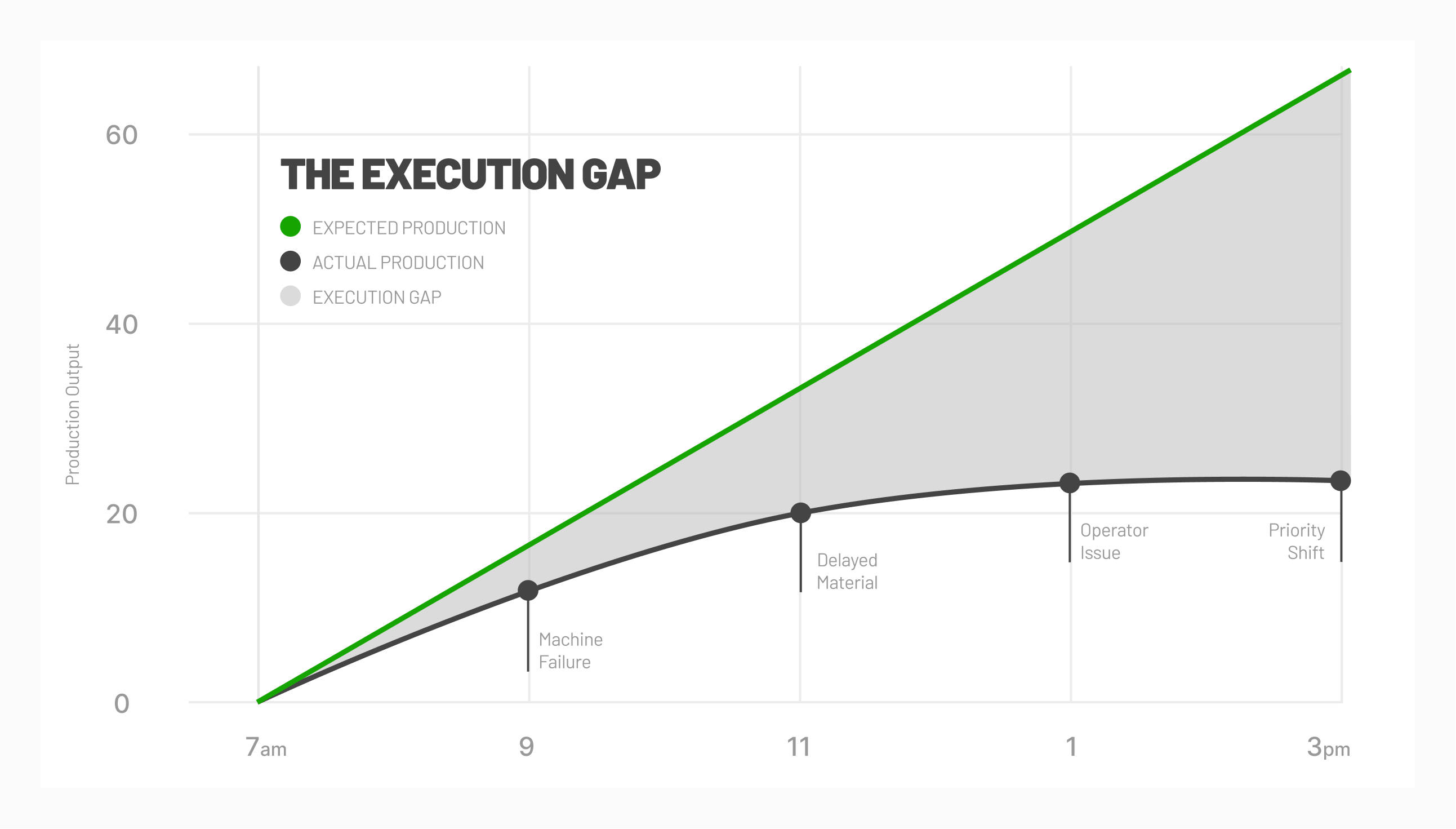

- How do you define utilization? We define utilization as when a machine is actively running. For machines where we get data from the PLC, we have various definitions based on application (and with consultation with the customer), but common definitions include when a G-code program is running or when the machine is outputting a status of ACTIVE from the control. For machines where we need to use sensors, we work in concert with the customer to determine the appropriate amperage threshold necessary to trigger an ACTIVE status, which varies based on the power output necessary to machine the part.

- Why is your utilization so different from the Federal Reserve’s capacity utilization figure? This is because of two reasons — one is a difference in definition, and the other is a difference in collection methodology.

- The Fed defines capacity utilization as the portion of utilized capacity, as a percentage of sustainable maximum output—the greatest level of output a plant can maintain within the framework of a realistic work schedule, after factoring in normal downtime and assuming sufficient availability of inputs to operate the capital in place (Source: https://www.federalreserve.gov/releases/g17/CapNotes.htm). It is up to the manufacturer to determine what their maximum sustainable output is, but manufacturers responding to the Fed surely don’t expect sustainable max output to be 100%, it’s typically somewhere near half of that (assumes maybe a ~80 hour workweek over three shifts). Our difference in definition stems from the fact that MachineMetrics assumes a 100% maximum sustainable output to calculate our utilization figure off of (a 168 hour workweek), in order to baseline our customers fairly and provide users of our data an opportunity to multiply our figures by an amount they deem appropriate.

- The Fed collects capacity utilization figures based off of surveys, asking manufacturers to fill in, every month, what they think the proportion of their total output they utilized was that month. It is prone to human error, non-response, and other issues with self-reported surveys. MachineMetrics collects utilization data autonomously from the machine itself, bypassing many issues associated with having humans in the loop. This is why we have visibility of up-to-the-minute updates of utilization, and why we believe this to be a more accurate representation of the truth.

- What is your sample size? Our sample size, after being in the market now for five years, is in the thousands of machines across hundreds of different customer sites.

- From a statistician’s perspective, we have a 95% confidence level that our sample size provides <2% margin of error, assuming a total market size of 200,000 machine tools (low-end estimate), and <3% margin of error, assuming a total market size of 700,000 machine tools (high-end estimate).

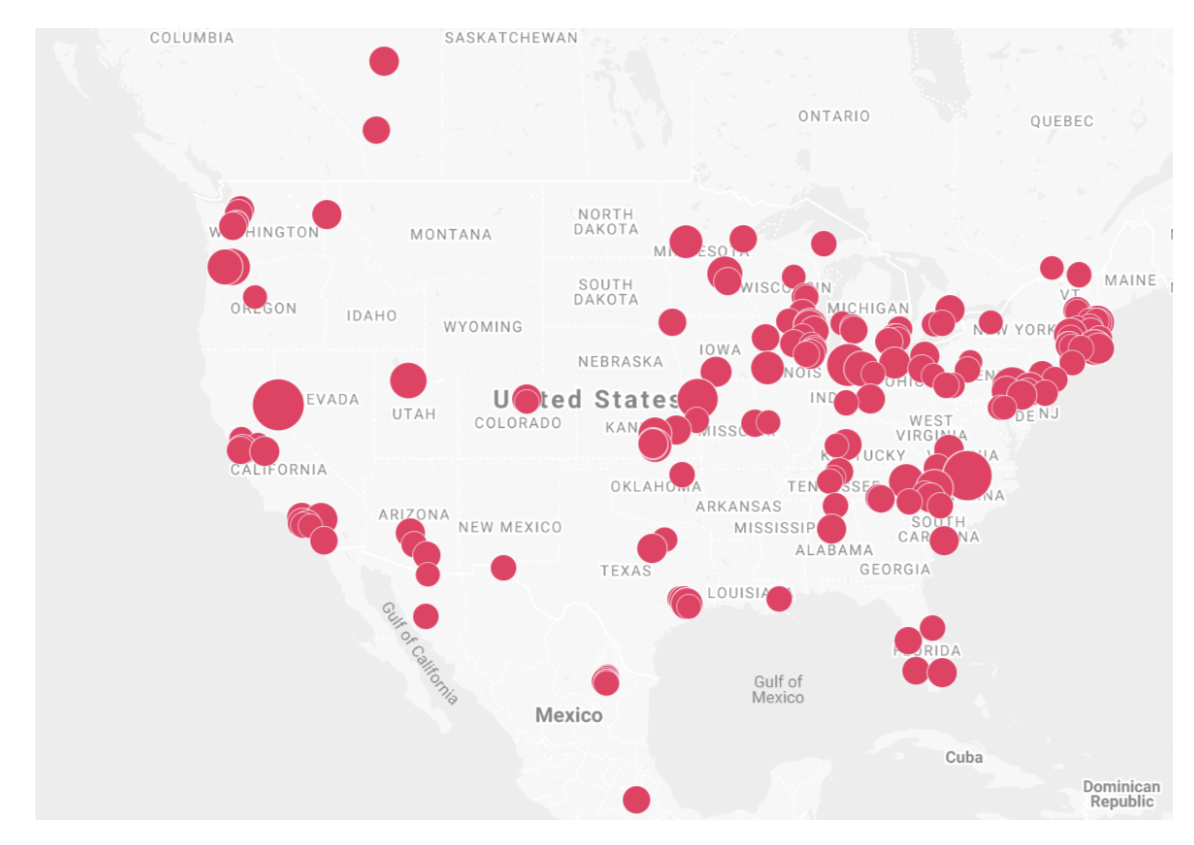

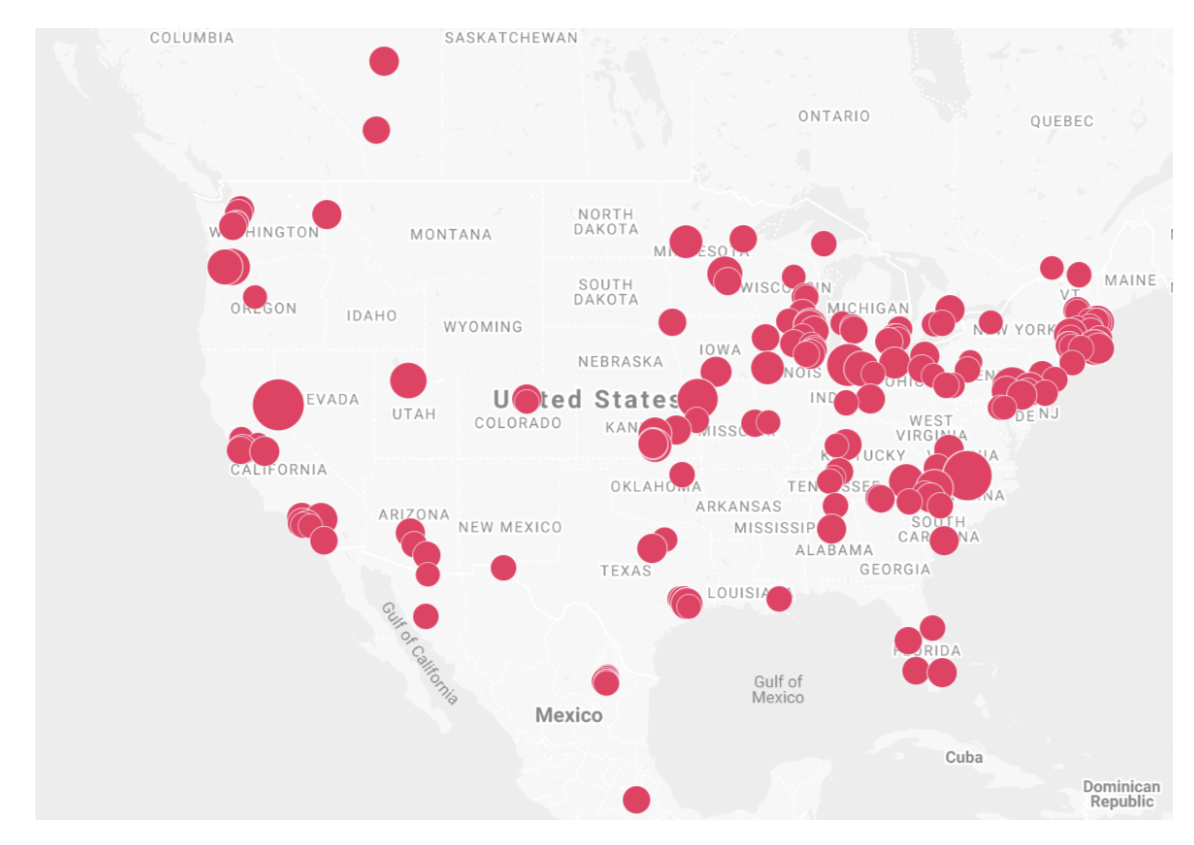

- We believe our sample size, based off industry and geography, to be slightly weighted towards the Northeast and towards Medical Device manufacturing and Industrial Machinery manufacturing as compared to the market as a whole. However, we also believe that we have a representative sample of the industry based off several external validation points — including, mostly notably, that we track very highly to Industrial Production of Miscellaneous Medical Goods (the Fed’s proxy for medical device manufacturing). A geographical distribution of our customers is provided for context below, with the size of the bubble roughly approximating the relative number of machines connected at each site.

5. Are there any particular assumptions or quirks with the data or methodology we should know about? Yes, there are several.

-

- Prior to COVID-19, customers and machines that disconnected from our service were simply excluded from our data set for future analysis. For the period of COVID-19, we have decided to include disconnected machines, and assume that they have 0% utilization rather than excluding them completely. This is because we infer these companies/machines shut down due to the current world events, rather than just having temporary connectivity issues.

- Our data is subject to minor revisions, especially in the last 48 hours, due to the fact that when machines come online again (reconnect to our edge device), they backfill the data that was buffered on them and re-write old records in our data warehouse. Machines sometimes experience minor disconnections from our service due to networking issues at the client site or even issues with our own pipeline, however rare. Therefore, the exact numbers are subject to change, but so far, general trends have persisted because these revisions are not systemic.

Closing Thoughts

As we make our way through the biggest pandemic in a century as a nation, it is important that we as a manufacturing community continue to support each other. We have confidence that manufacturing will recover, and we believe our live updates to data will help inform policy-makers and manufacturers of the true state of the industry.

We wish you the best in these times, and please don't hesitate to reach out to us with any questions.

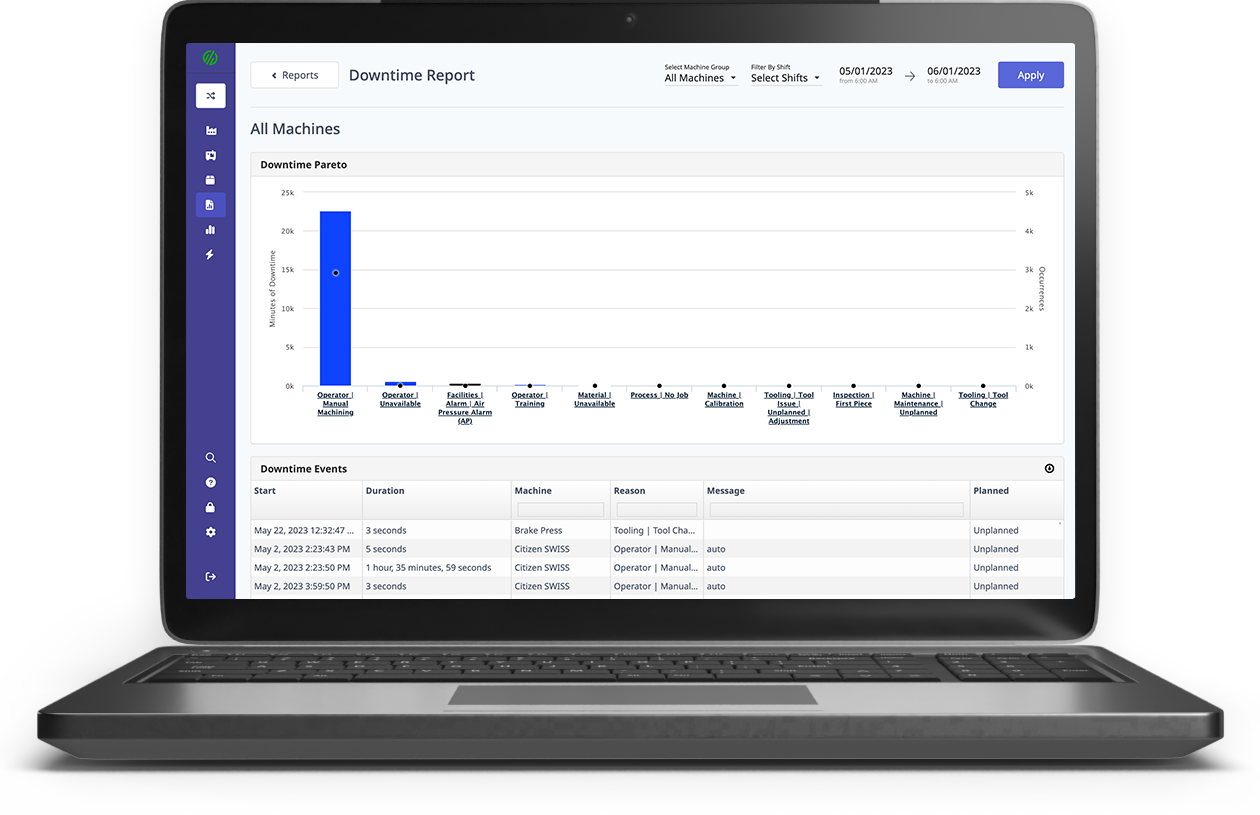

.png?width=1960&height=1300&name=01_comp_Downtime-%26-Quality_laptop%20(1).png)

Comments