Key Takeaways:

- The GVSU symposium highlighted strategies for overcoming market turbulence in automotive.

- Focus on innovation and flexibility is critical in navigating uncertain market conditions.

- Collaborative approaches can help suppliers stay resilient during economic shifts.

Last month, I attended the Grand Valley State University Automotive Supplier Symposium in Grand Rapids, MI. As a manufacturing technology professional, the event was incredibly thought provoking and there were two presentations in particular that resonated with me.

First, the Symposium’s keynote was delivered by David Leich, executive director of supply chain for GM, who shared what GM is doing to ensure supply chain resiliency amongst the many disruptions going on today as well as what suppliers should expect moving forward. The second was a presentation delivered by Mike Wall, executive director of automotive analysis from S&P Global Mobility (formerly IHS Markit), who delivered hot off the press scenarios for global automotive production in light of the recent Russia-Ukraine war.

Below are the most important and impactful topics that David and Mike covered in their sessions as well as insights on how manufacturers can prepare themselves to navigate ever changing industry dynamics.

Why can't I find a new car to buy!?

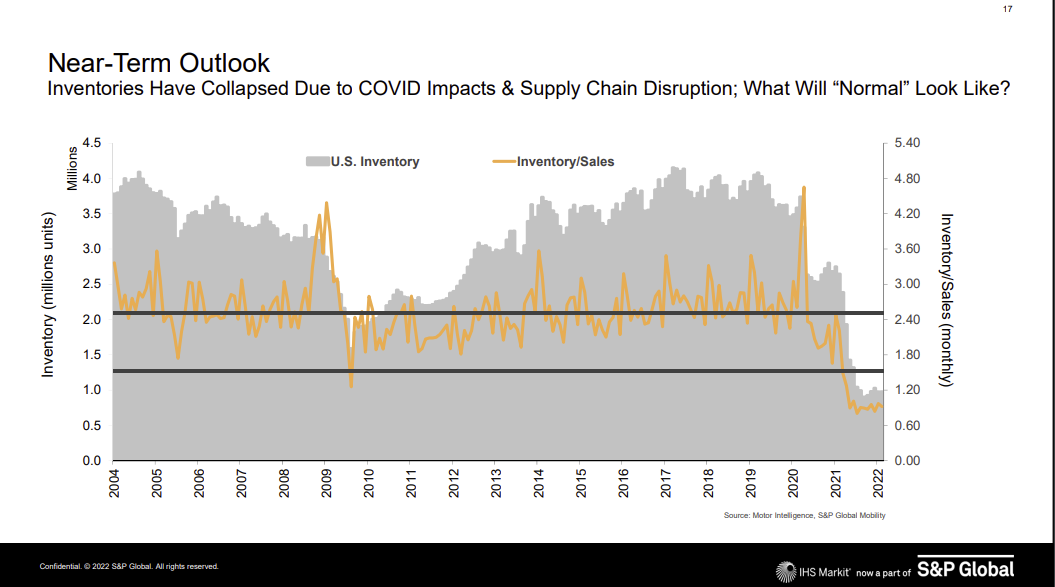

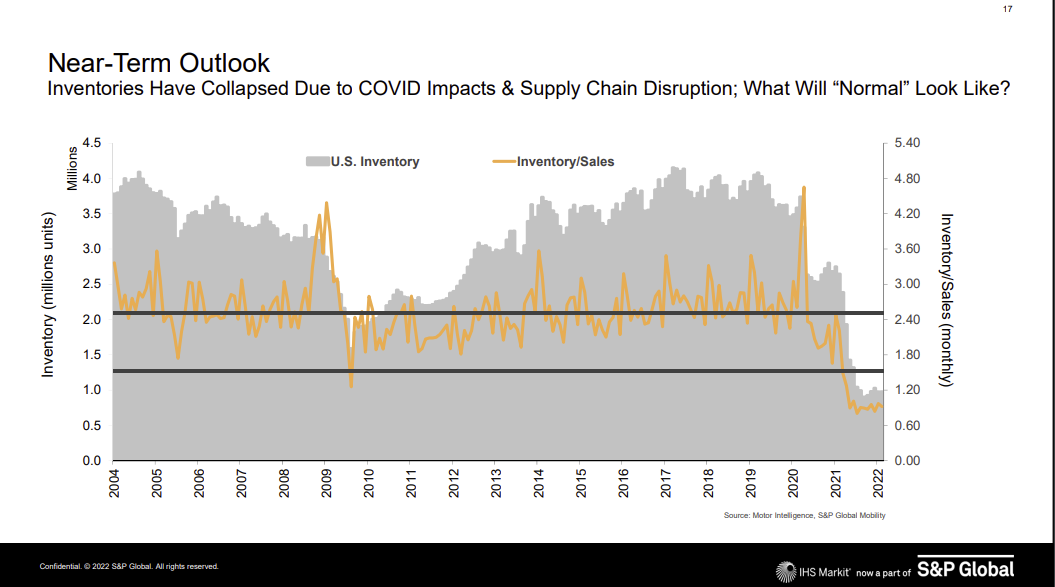

- KEY STAT: New vehicle inventory in the U.S. has collapsed to 1.22MM units compared to pre-Covid levels of 4MM units.

David Leich from GM came out with an untraditional statement: 'OEM production will be decoupled from demand and inventory is the name of the game'. Basically, demand has no bearing on GM's production schedules and they are running around the clock to build back up inventories. As mentioned above, dealer inventories are so historically low right now that GM and David believe that even if the economy were to take a nosedive (not projected though), it would not have a material impact on their production for the next couple years! Wow, talk about an eyebrow raiser!! His position really exposes the challenge on the inventory front right now for OEMs.

Driving from West Michigan to Chicago, thank you Semiconductors!

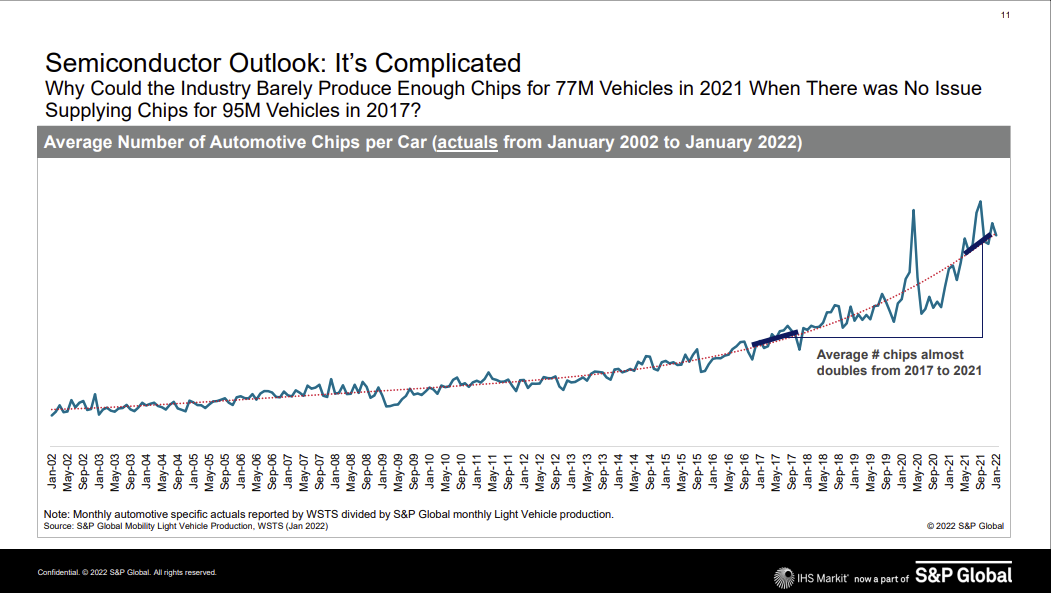

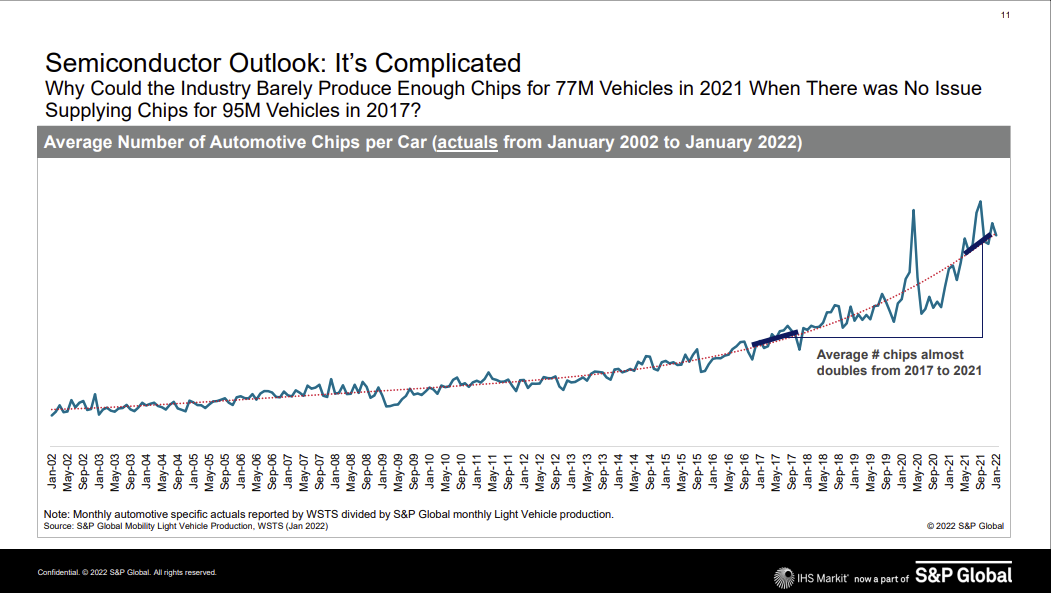

- KEY STAT: The number of semiconductors in vehicles has doubled over the last 4 years.

On a recent business trip, I drove a rental car that was equipped with Highway Driver Assist (HDA) and Adaptive Cruise Control. As I made the drive from western Michigan to Chicago, I was initially annoyed with this technology largely due to my naïveté and stubbornness to accept it. However, after tinkering a bit with the HDA, I fell in love with how effortless this three hour drive became. These extra luxuries are becoming the norm and what was once a differentiating feature will soon become a standard offering. What does this have to do with the Symposium? Because these new safety and convenience features are a perfect example of why we are seeing an exponential increase of semiconductors in new vehicles that Mike Wall of S&P Global Mobility highlighted during his session (see graph below) - as you can see, the number of semiconductor chips in vehicles has doubled from 2017 to 2021! Whoa, this trend will certainly continue as vehicle telematics, enhanced safety and electrification become more mainstream. So what is GM doing about it? Read on.

GM's answer to disruption is Supply Chain Resiliency

The semiconductor shortage is not the only challenge facing automotive suppliers. Global political turbulence, most notably the Russia-Ukraine War, continues to have a dramatic impact on the supply chain. As Mike Wall explained, the crisis in Ukraine has especially impacted cable assemblies and has already contributed to around a 90k unit loss to the global vehicle production. Another example is the vaccine protests that took place at the Canadian border in February. In that instance, GM took matters into their own hands and rented large ferries to transport semi-loads worth of parts across the Detroit River while the Ambassador Bridge connecting the two countries was shut down.

That is a very specific example of how GM approaches supply chain disruption, but the company is taking a multifaceted approach to ensuring their supply chain remains resilient in turbulent times. It starts with GM driving down into the sub-tier - here is how they plan to increase their engagement with this group of manufacturers:

- Mapping out all levels of the supply network and developing risk profiles for suppliers of higher risk components, such as those with a single source or parts with longer lead times.

- Sharing forecasts and releases directly with those sub-tier suppliers to mitigate risk. Incentivizing suppliers to the Tier 1s to share supply chain data to their trading partners

- Risk balanced supplier selection shift(inventory reserves vs. JIT)

Industry Trends and Impacts

In their sessions, both David Leich and Mike Wall emphasized that labor and supply chain disruptions are here for the foreseeable future. Below are a few notable trends these experts are anticipating:

- GM will be running at maximum overtime for the next several years in order to build up inventories to pre-Covid levels. As a result, manufacturers should anticipate continued labor challenges across the industry as the battle for talent continues to increase.

- Availability of long-lead components and equipment capacity challenges will also continue for the next few years.

- Cybercrime will continue to increase and it is expected that, by 2031, a ransomware attack will occur every three seconds.

- GM will have over 70 new electric vehicle launches in the US over the next two years.

- This fast shift is due to increasing regulations around internal combustion engines and investors’ desire to reward electric vehicle initiatives.

- S&P Global Mobility’s forecast for North American Light Vehicles projects a bounceback of +13% YOY in 2022, noting that it will continue to normalize to historical norms in subsequent years.

How Automotive Suppliers Can Prepare

As OEMs focus on replacing their severely diminished dealer inventories and ramping their electric vehicle efforts, automotive suppliers will need to be laser focused on how to increase or, at a minimum, maintain their current productivity. These manufacturers will no doubt be forced to make critical decisions, such as: “Do I invest $500K in a new piece of equipment or automation,or do I increase my starting wages to attract more front-line labor?”

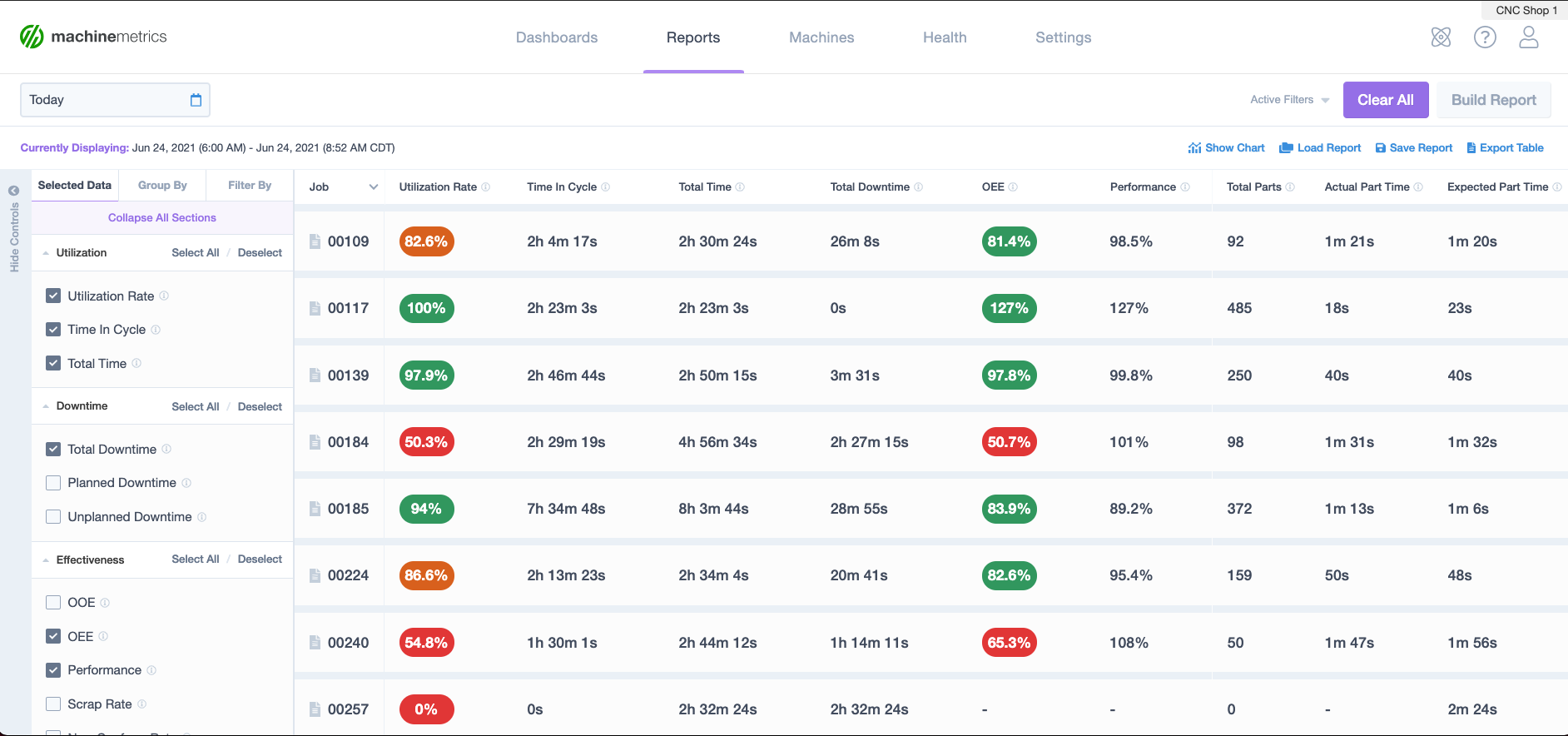

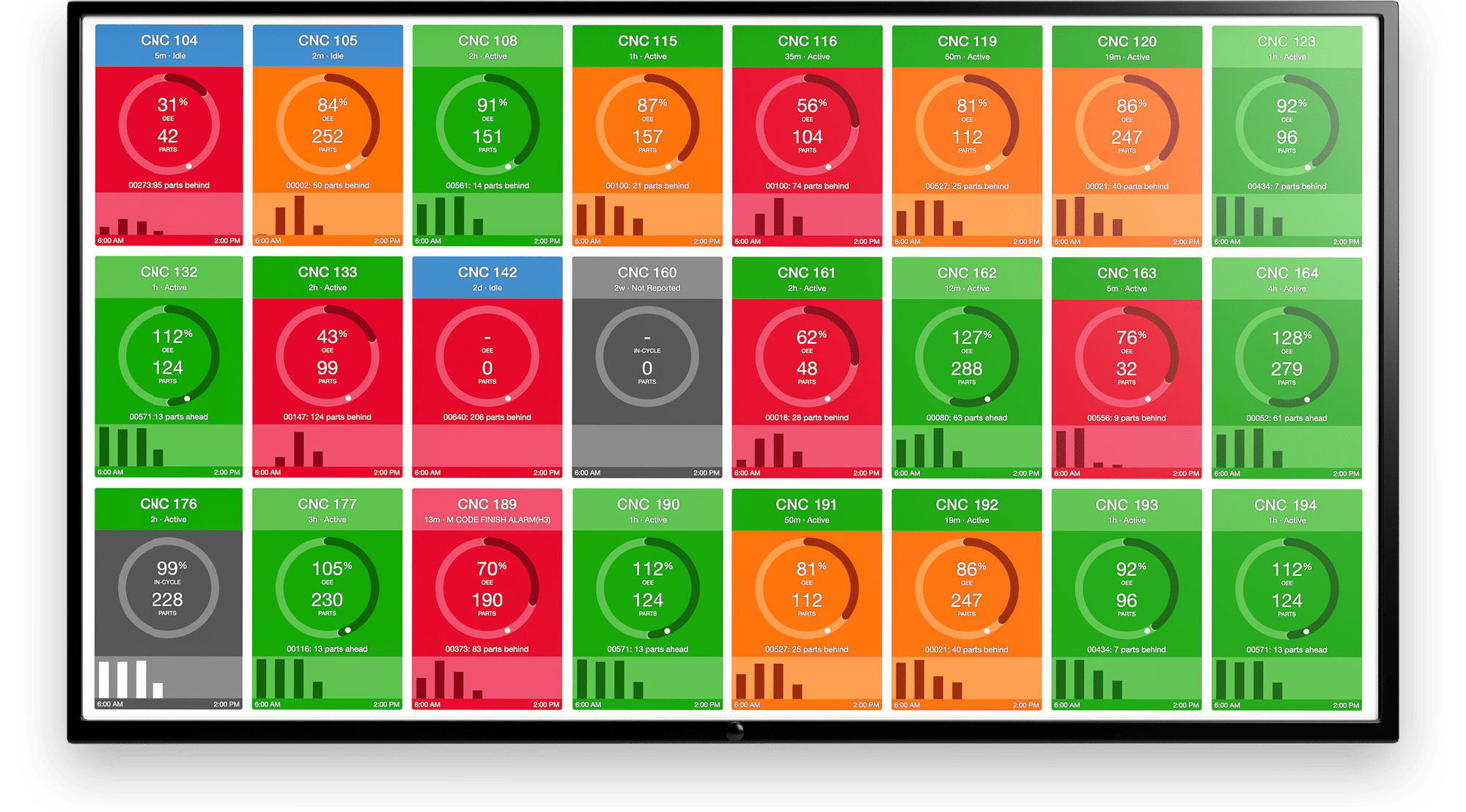

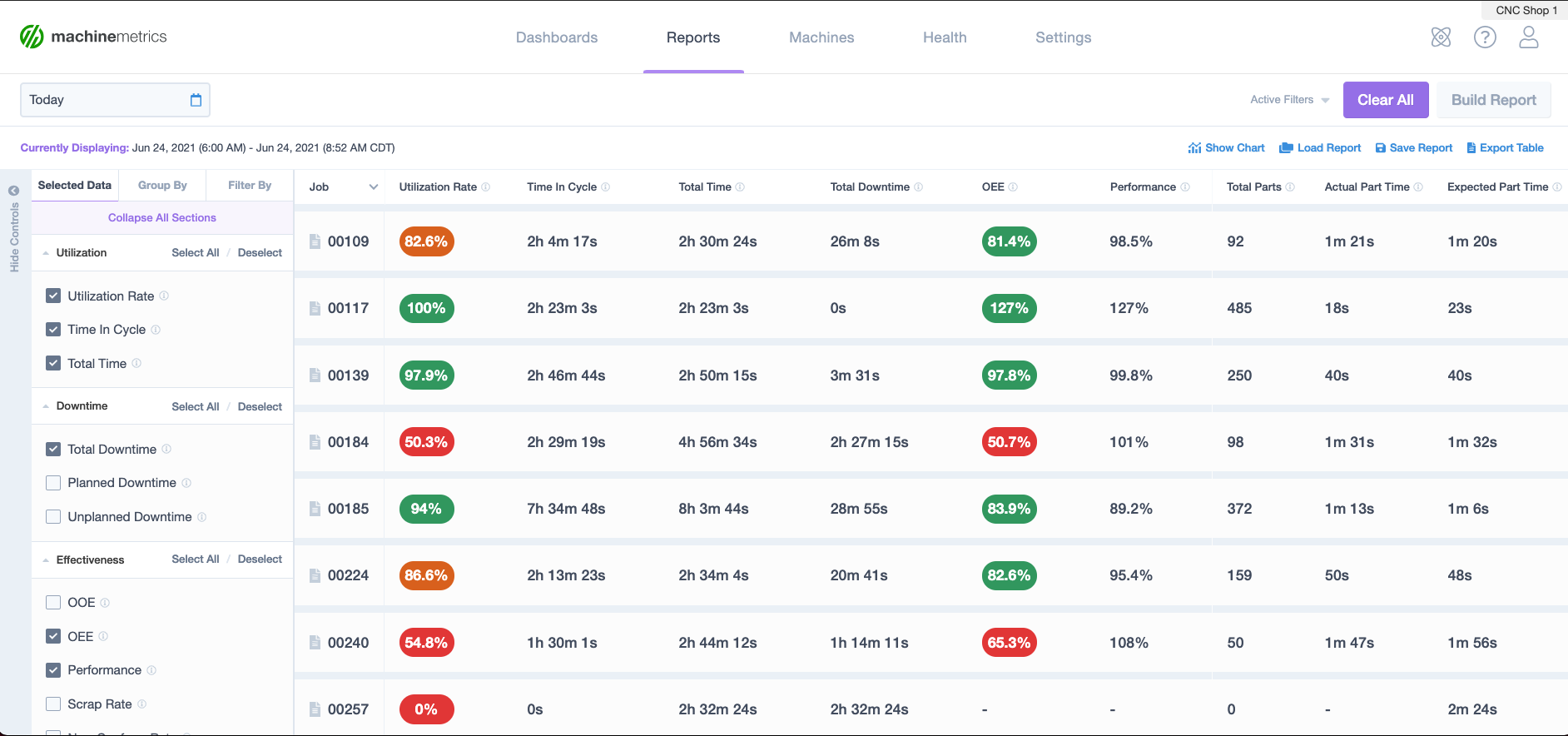

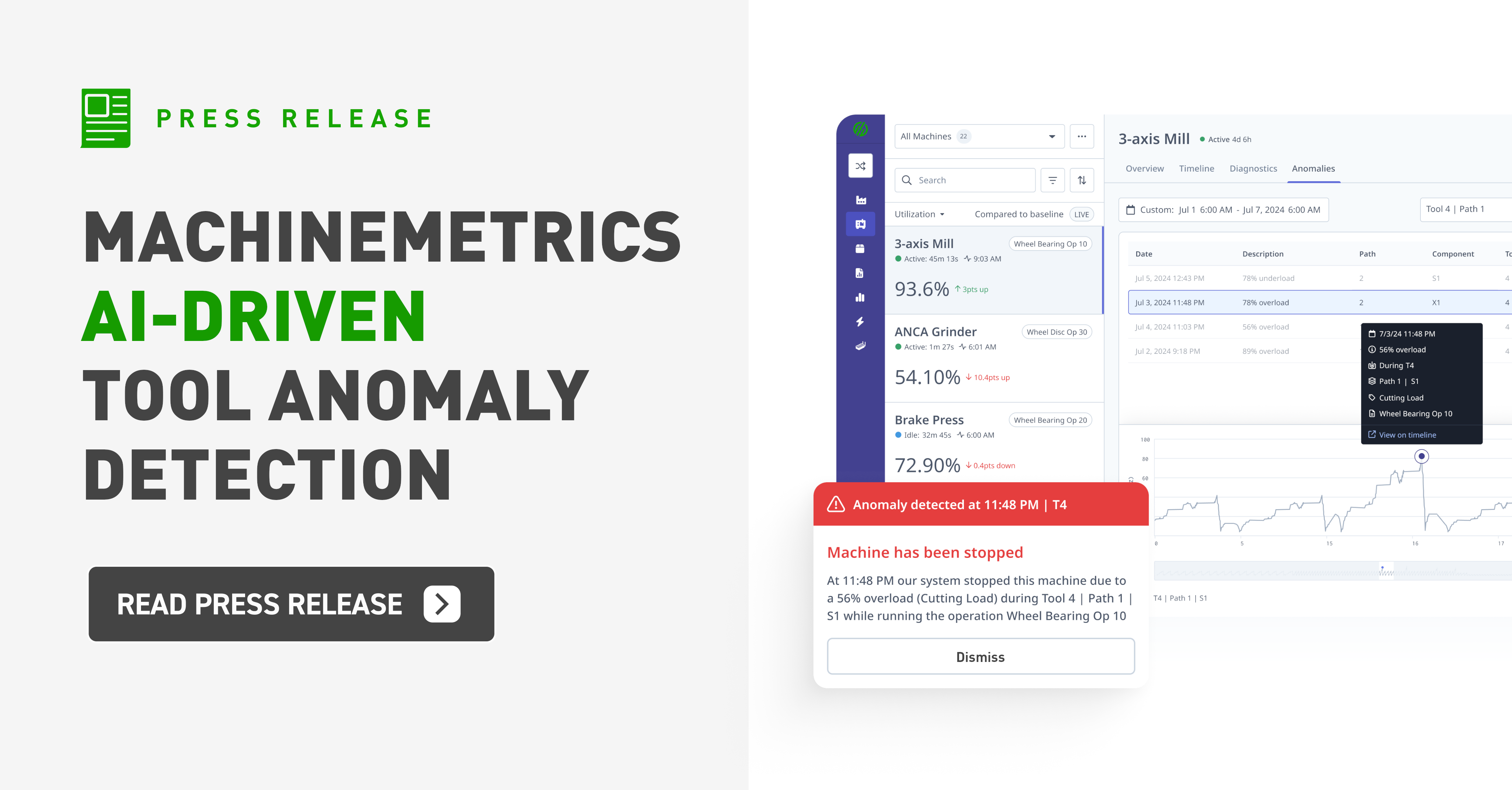

To make truly informed decisions, manufacturers first need a clear and accurate assessment of their current and potential productivity capabilities. The MachineMetrics platform helps manufacturers achieve this by providing an unbiased, data-driven view into their plant's capacity by connecting directly to manufacturing equipment via the machine's controller or PLC. Live real-time insights, such as true cycle time of a machine, part or process, can then be reconciled against theoretical job & part standards.

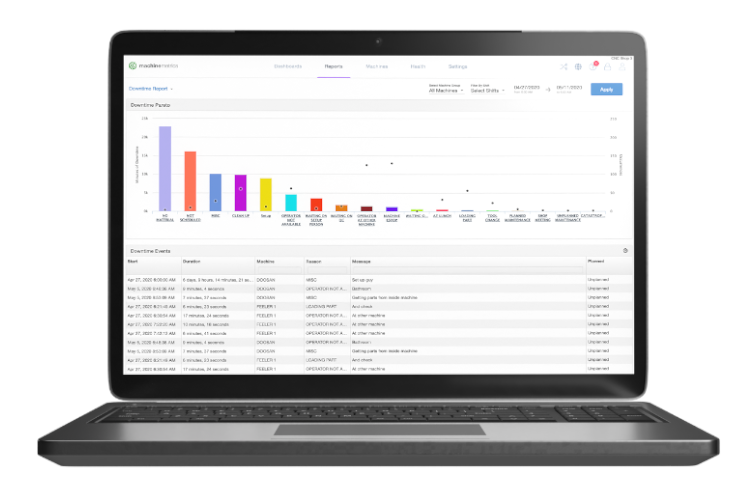

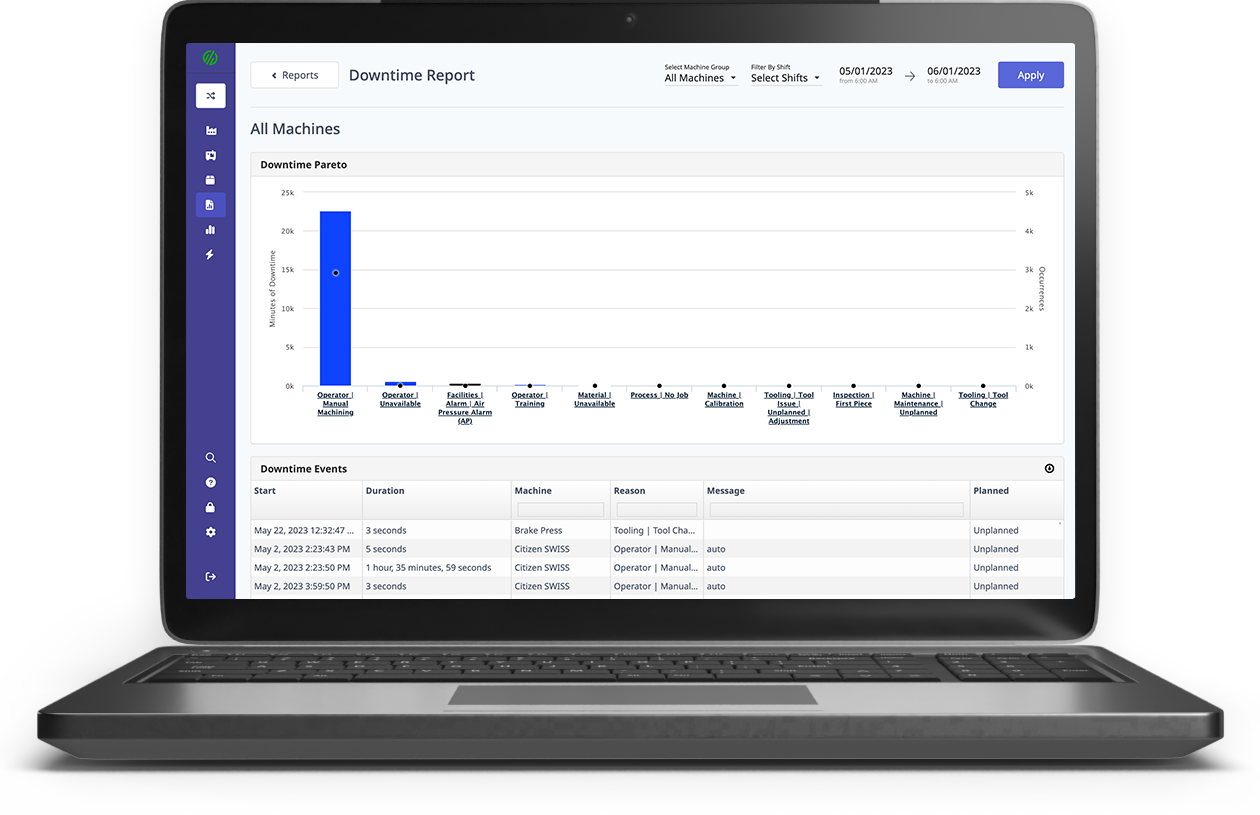

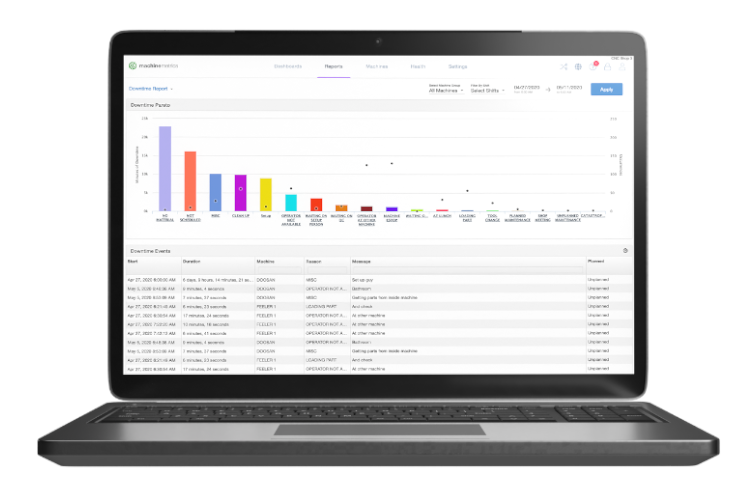

Additionally, manufacturers are able to cut out waste and discover the root cause of downtime by automatically exposing machine alarms such as a tool failure or material feed issue. MachineMetrics’ out-of-the-box report builder enables manufacturers to Pareto out those downtime reasons in order to expose a real issue like lack of labor or excessive unplanned maintenance. This type of insight is hugely valuable for a manufacturer that is trying to decide whether to make that new equipment purchase or not.

Lastly, it is essential that manufacturers’ software platform is not only secure from cyber threats but is also scalable to enable collaboration amongst supply chain partners. MachineMetrics prides itself as being ISO 27001 certified and having achieved the Amazon Web Services (AWS) Industrial Software Competency status, a designation that differentiates MachineMetrics as an AWS Partner Network (APN) member that has delivered specialized solutions that align with AWS architectural best practices for building the most secure, high-performing, resilient, and efficient cloud infrastructure for industry applications.

Since we are a Software-as-a-Service(SaaS) provider, sharing these key insights to select partners is as easy as pulling up your web browser on your computer or phone.

There are turbulent days ahead for manufacturers of all kinds. To navigate these market dynamics, it is essential to utilize technology that empowers informed, strategic decisions, enables continuous improvement, and provides an accessible platform that drives supply chain collaboration while maintaining high security standards.

Discover how MachineMetrics enables automotive manufacturers to make better, faster decisions with machine data. Or, download our eBook on the current state of automotive manufacturing:

.png?width=1960&height=1300&name=01_comp_Downtime-%26-Quality_laptop%20(1).png)

Comments