Search

SUGGESTED CONTENT:

Easthampton, MA – October 16, 2025 – MachineMetrics, the Intelligent MES and industry leader in machine connectivity, today announced the launch of Manual Stations - a powerful solution that enables

press release

/ Oct 15, 2025

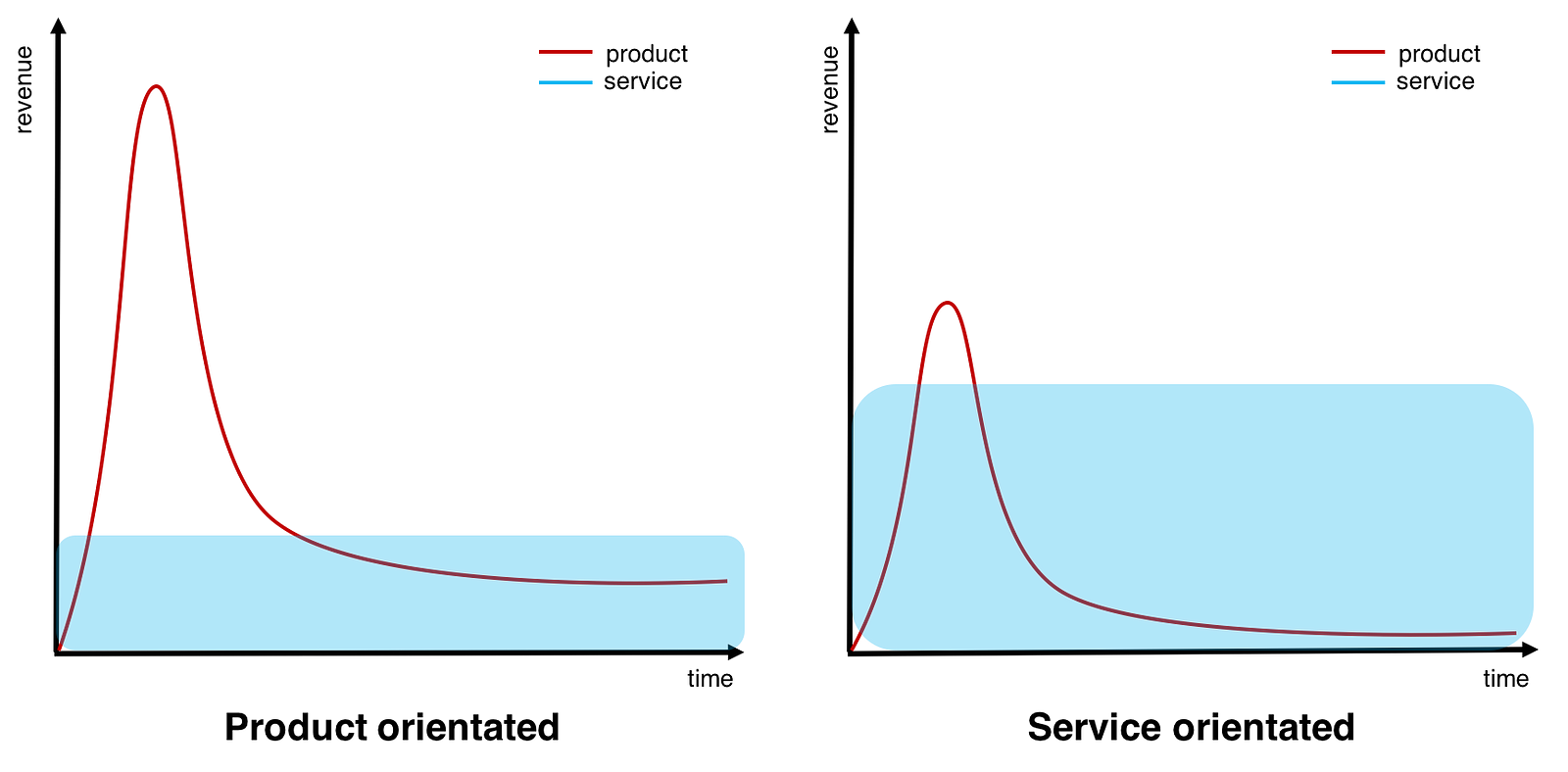

The Hidden Half of Manufacturing Despite massive investments in automation, the majority of manufacturing work is still performed by people. In fact, studies show that 72% of factory tasks are

MachineMetrics

/ Sep 29, 2025

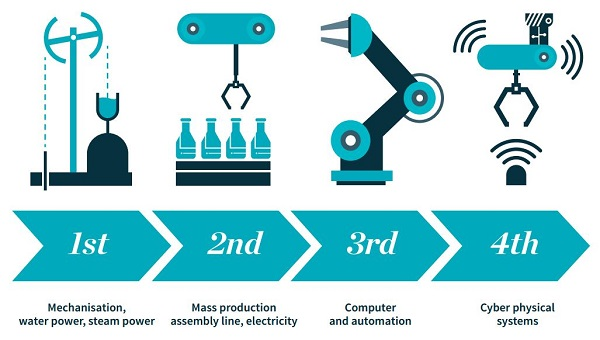

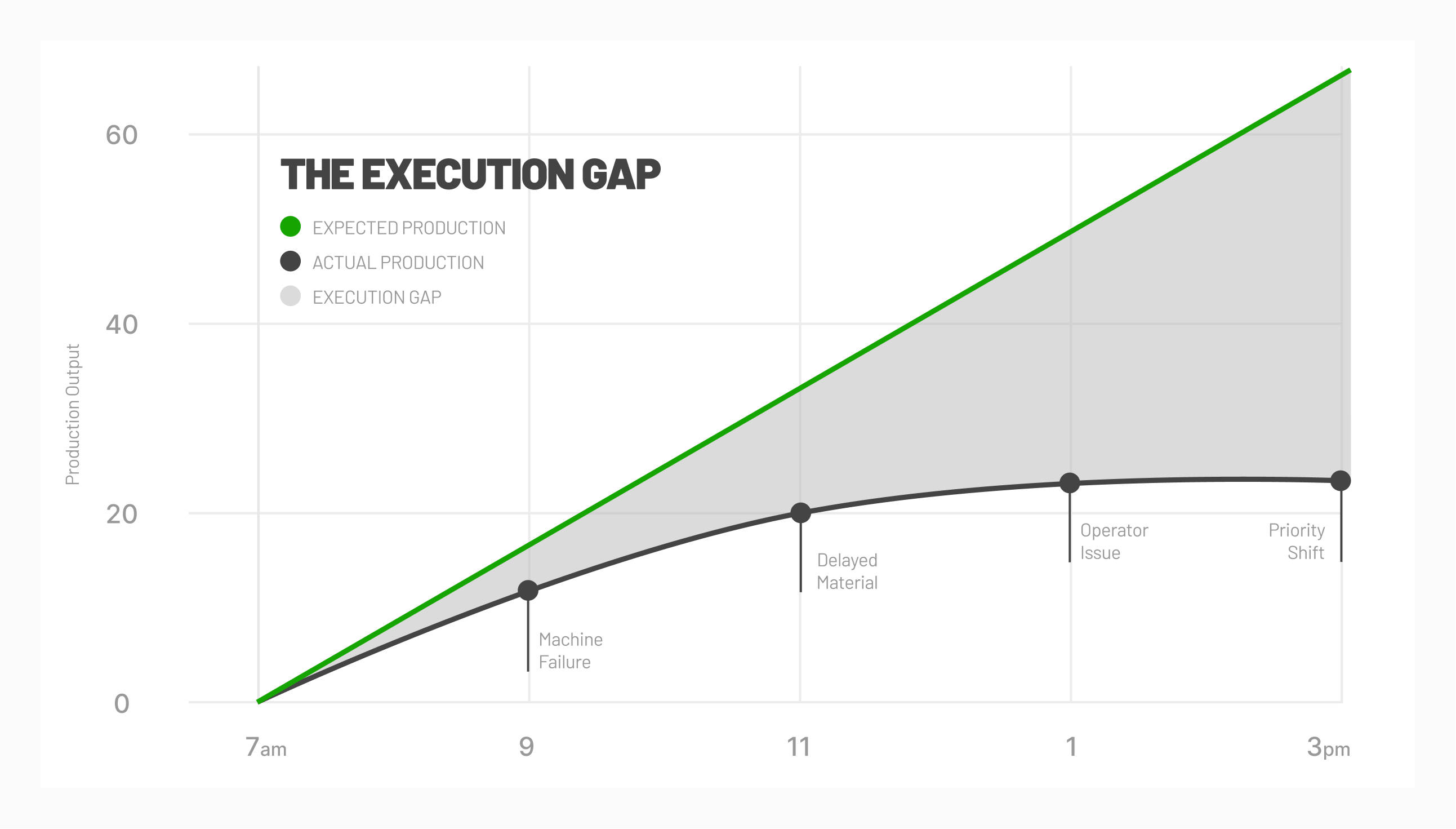

EASTHAMPTON, MA – September 19, 2025 – Manufacturing has always been defined by its ability to plan and challenged by its ability to execute. ERP systems outline the ideal production path: what to

press release

/ Sep 19, 2025

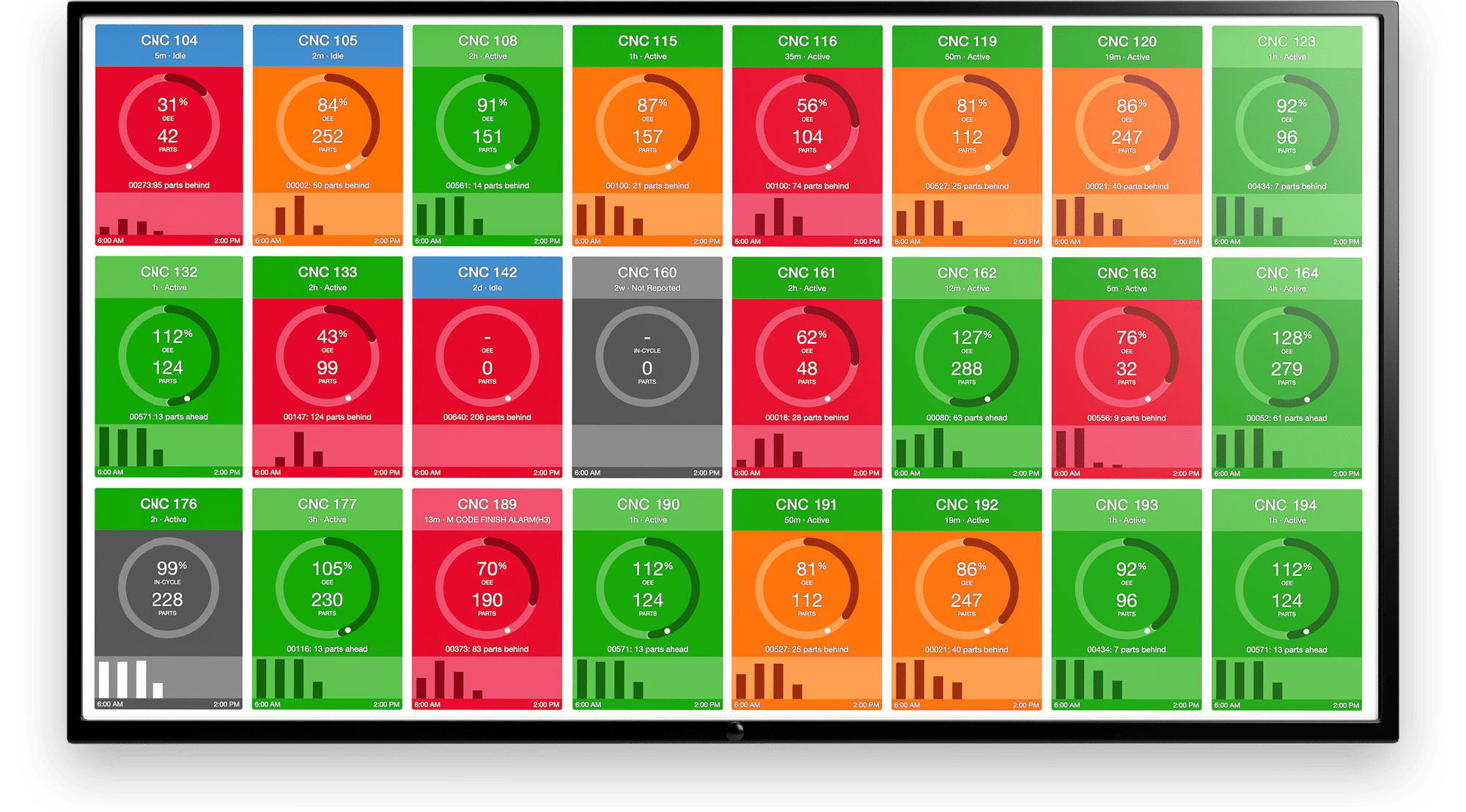

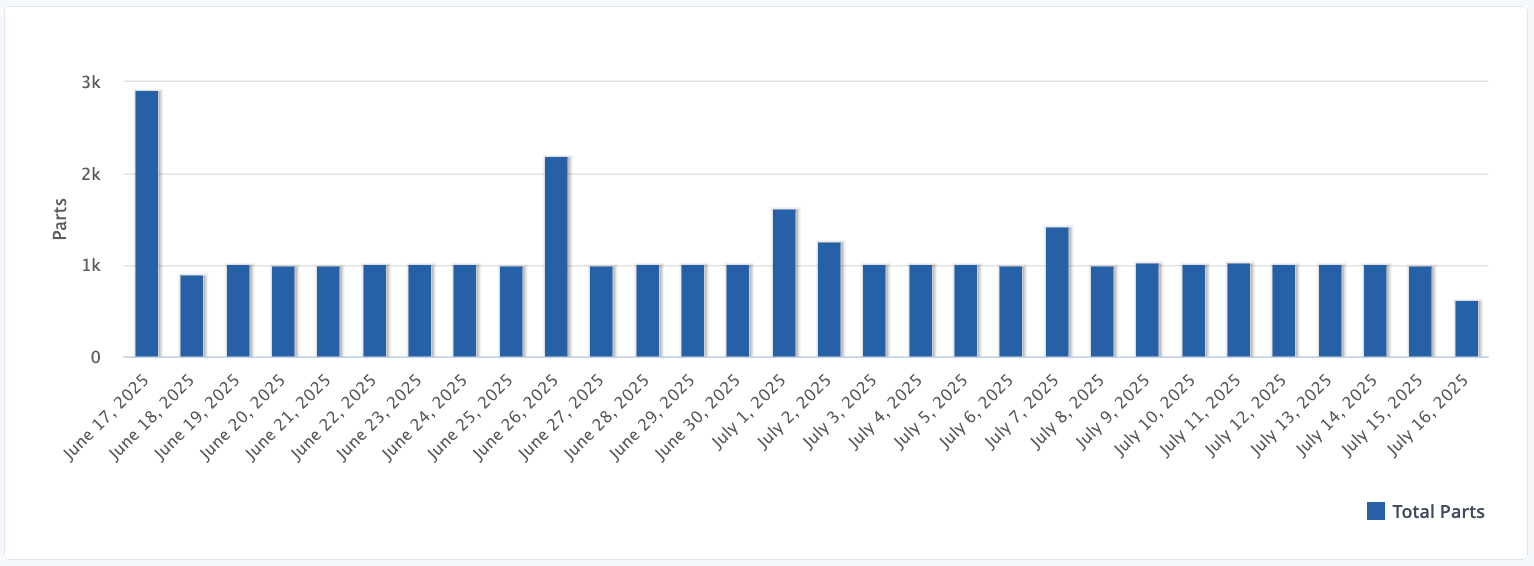

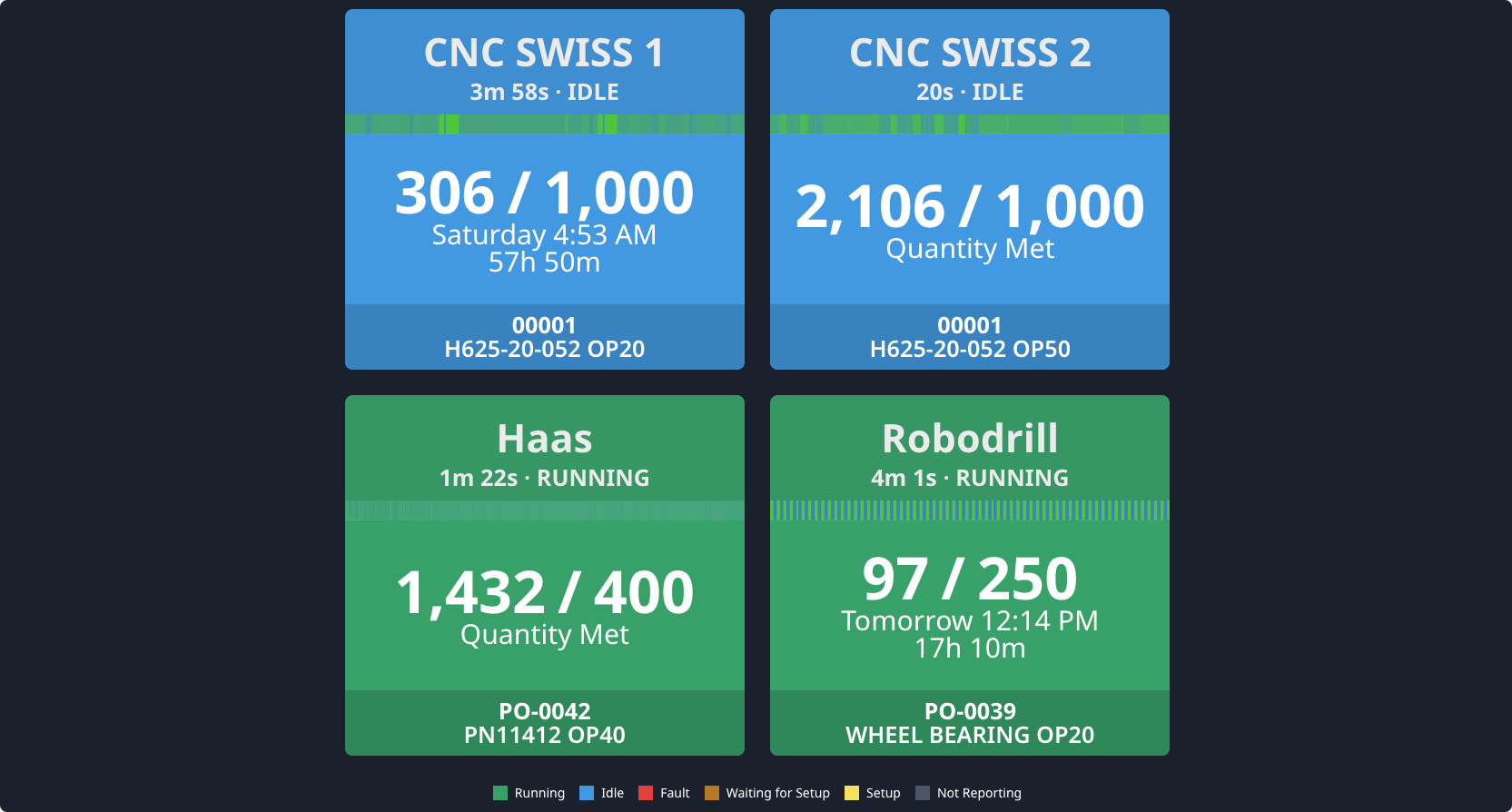

Most manufacturers don’t have a data problem. They have a decision problem. In fact, most manufacturers are drowning in data - machines stream data 24/7. Dashboards display utilization, OEE, and

MachineMetrics

/ Sep 02, 2025

START DRIVING DECISIONS WITH MACHINE DATA.

Ready to empower your shop floor?

Learn More

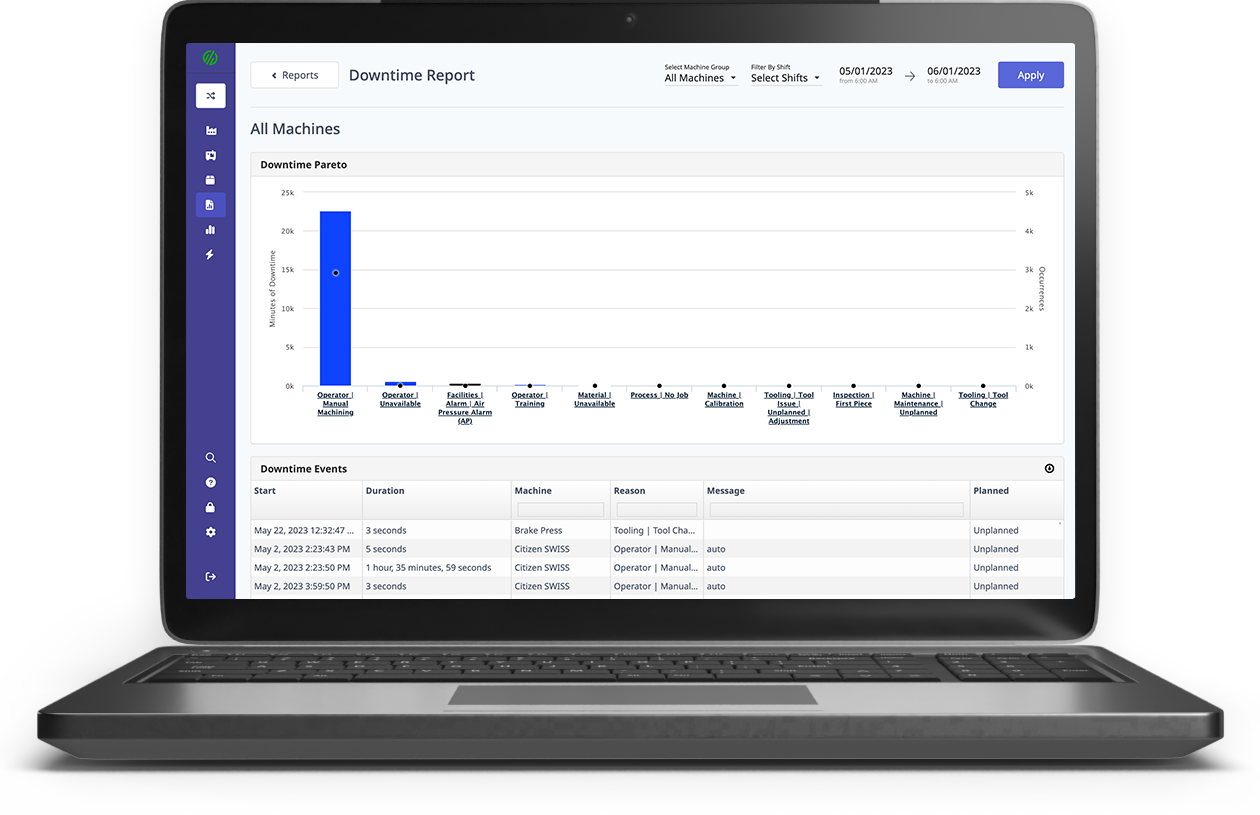

.png?width=1960&height=1300&name=01_comp_Downtime-%26-Quality_laptop%20(1).png)

Comments