While many of us are starting the new year resolving to transform ourselves by hitting the gym, eating better, and spending less money, manufacturers have the onus of a far more important transformation on their hands: embracing the changing digital manufacturing landscape and emerging Industry 4.0 technology.

In 2019, the Internet of Things (IoT) has finally gained momentum within the industrial space, and manufacturers are now able to leverage a whole new arsenal of data to drive decisions with. In an increasingly complex manufacturing environment, companies are looking for any edge to remain competitive in a heavily globalized economy.

At MachineMetrics, our goal is to empower our customers with the data they need to gain that necessary edge, enabling them to remain both profitable and as competitive as possible. For years, our hundreds of customers have been using MachineMetrics to drive performance and reduce unplanned downtime. MachineMetrics’ unique ability to easily connect to any machine has allowed our platform to quickly gain tremendous traction and aggregate what we believe is the most powerful global dataset of machine performance in the world. Through analysis of this anonymized aggregate data, we can now provide the highest level of insight back to our customers, partners, and the manufacturing community.

With the release of our 2019 State of the Industry (SOTI) for CNC Machining, we are delivering on that promise to a level never achieved before, and we are thrilled to make it freely available to everyone this holiday season. Driven exclusively by real manufacturing data collected from hundreds of companies and thousands of machines globally, MachineMetrics’ report is a first of its kind and delivers confirmation for many gut feelings about the industry as well as uncovers unexpected manufacturing behaviors and trends never made visible before.

Until now, no business has had the capabilities of MachineMetrics to connect to as many machine types and aggregate the data necessary to accurately deliver these insights in a report with true statistical significance. Previous industry SOTI reports have been compiled based on self-reported, voluntary survey responses that require data from the contributor in return for survey results. Along with the fact that the majority of manufacturers simply do not have access to the necessary data, self-reported surveys are often inaccurate.

The difficulty of collecting such a dataset cannot be understated. Data in the manufacturing industry continues to be siloed by individual companies, with each manufacturer keeping their data for themselves. Economic downturns or slowdowns in business often cause non-reporting, as more imperative business matters trump using resources to report to a survey. However, this is often when businesses need industry information the most -- in a month where there’s a blip in sales, knowing where one stands and what segments to focus marketing efforts on can be of paramount importance to recovery.

2019 in review: What type of insights do we see?

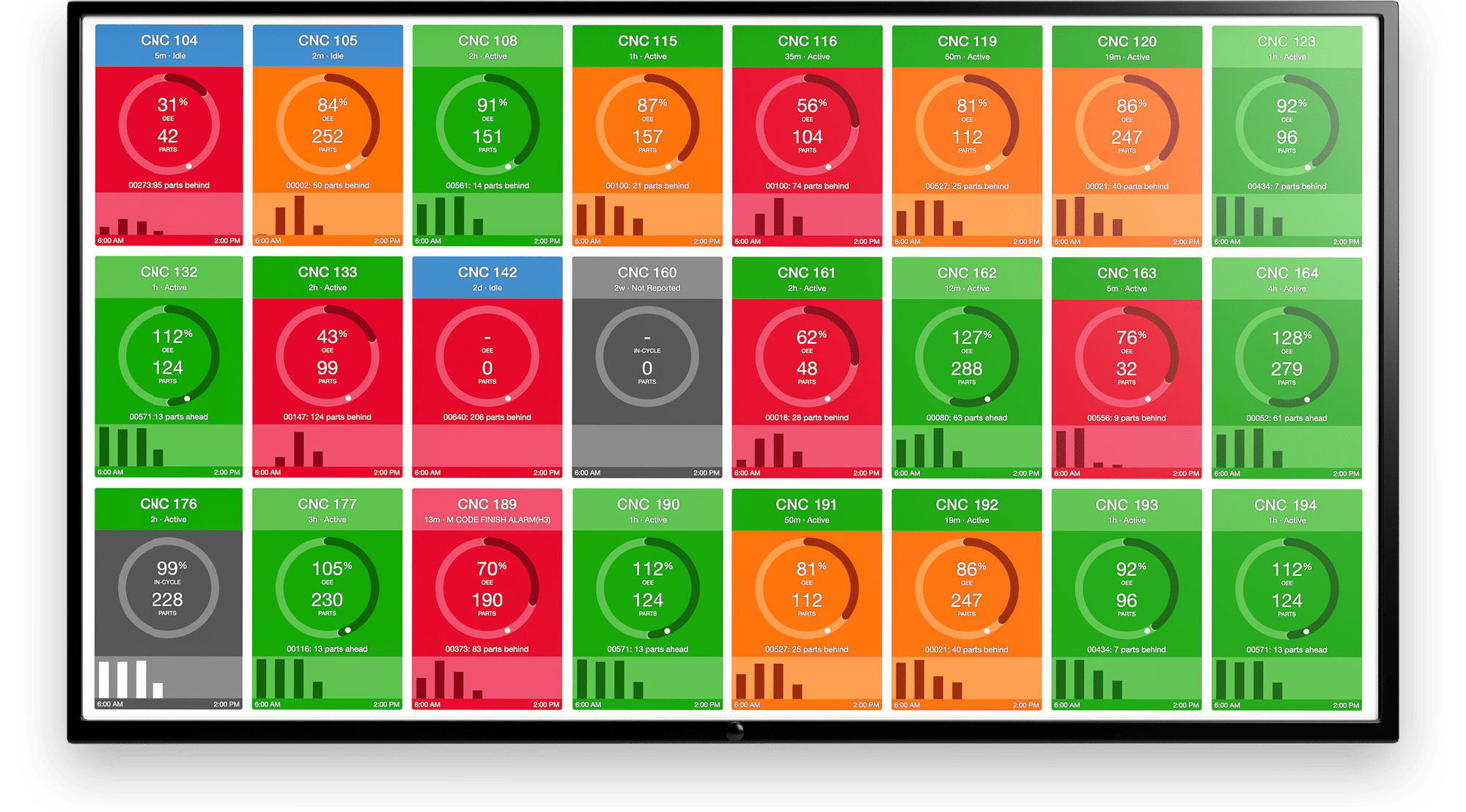

We break our report into three sections: machine-level insights, plant level insights, and economist level insights, with each section telling its own unique story driven by data. For example, over the course of this year, we see trends for each specific machine type, with Grinders being especially high performers. Utilization for most machine types vary approximately in tandem with each other, showing stronger performance earlier in the year. This reflects a slowdown in manufacturing this year.

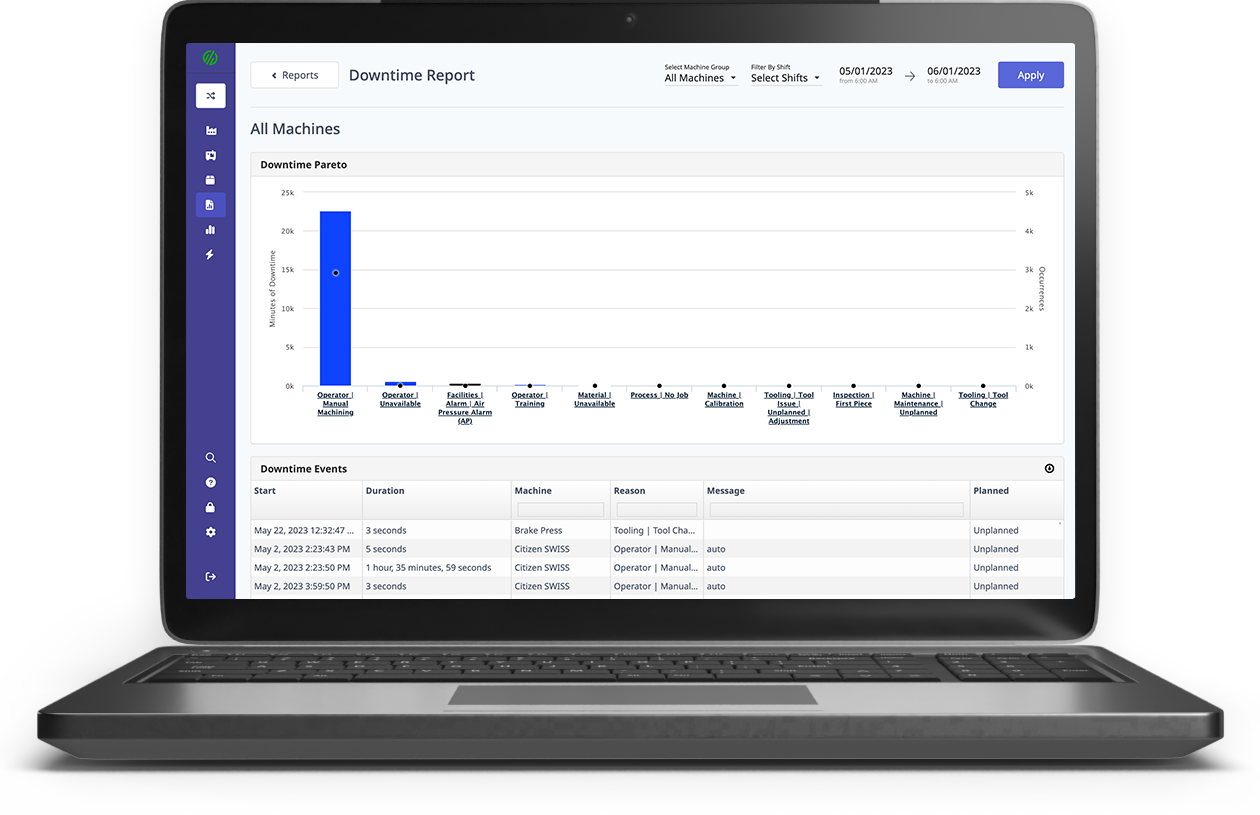

But, in addition to collecting raw utilization data, we also prompt operators to provide reasons for long periods of downtime. Looking at the rates at which various downtime reasons occur reveals a kind of “fingerprint” for each machine type in terms of its average operational and maintenance needs. Stamps stand out as particularly prone to losing productivity due to lack of an operator, and also tend to be stopped more often for changeovers. This is consistent with their overall low utilization. Horizontal lathes exhibit relatively high rates of cleaning and planned mechanical service compared to other machine types. By contrast, Grinders and Swiss CNCs encounter downtime more rarely and generally for broader sets of reasons. A shop owner could learn a lot about their own machines and operations by comparing against these patterns.

Digging into data at the factory level (all machine data aggregated together) reveals even more unique insights. We calculate utilization for each of the companies that we work with by averaging over all of the machines in their individual shops. What happens when we look at the distribution of these company-level utilizations among our customers? Most companies appear to perform at the 25% utilization level, with a few high-performers stretching into the 60’s. A shop owner can get an immediate sense of how competitive they are by just learning where they fall on this curve.

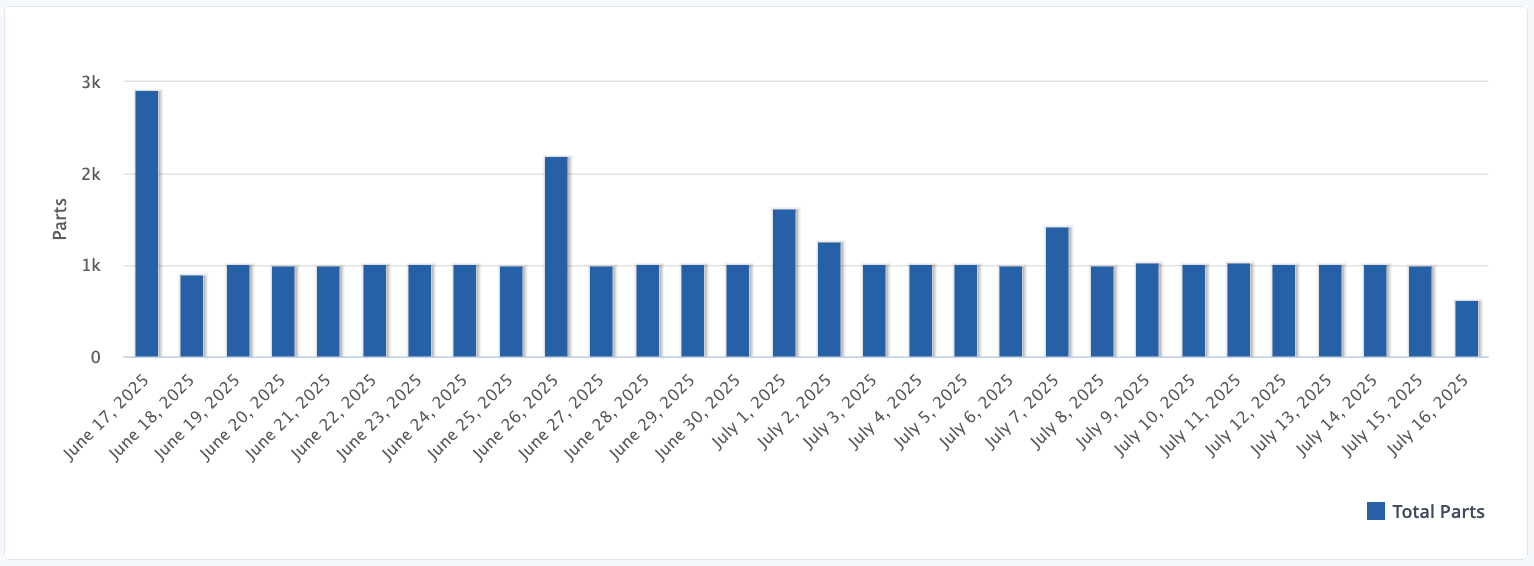

Finally, aggregating over all machines for all of our companies, industry-wide trends are revealed. One of the most basic questions that we can ask is: “On what days of the calendar year are machine shops actually up and running?” Utilization is lower for the week of Christmas, suggesting it’s when many shops are shut down, but not for many federal holidays like Columbus day or MLK day. These insights can help inform your HR policy. What days are other employees taking off? Perhaps it makes the most sense to align your operation’s holidays with those of the industry, which can help align resources to best serve your customers. At MachineMetrics we did this. We are adding more holidays around Christmas and removing Columbus and MLK day holidays as a result of this data.

Our data has also been tracking our correlation to several economic indicators, and we’ve found ourselves to be highly correlated to several key economic series including Industrial Production for Miscellaneous Metal Goods (the Fed’s proxy for Medical Device Manufacturing) and Value of Manufacturers’ Shipments for Motor Vehicle Components. This makes sense to us, as automotive and medical are two of the biggest industries discrete manufacturers serve. When MachineMetrics’ customers manufacture more of the component parts of cars and medical devices, their utilization goes up. The output of machined goods like engine parts, brakes, surgical implants, and bone screws serves as a very tight correlate to the production of the products they ultimately go into: motor vehicles, trucks, metal implants, etc.

Regarding 2020: what does this all mean for the industry and the future of manufacturing?

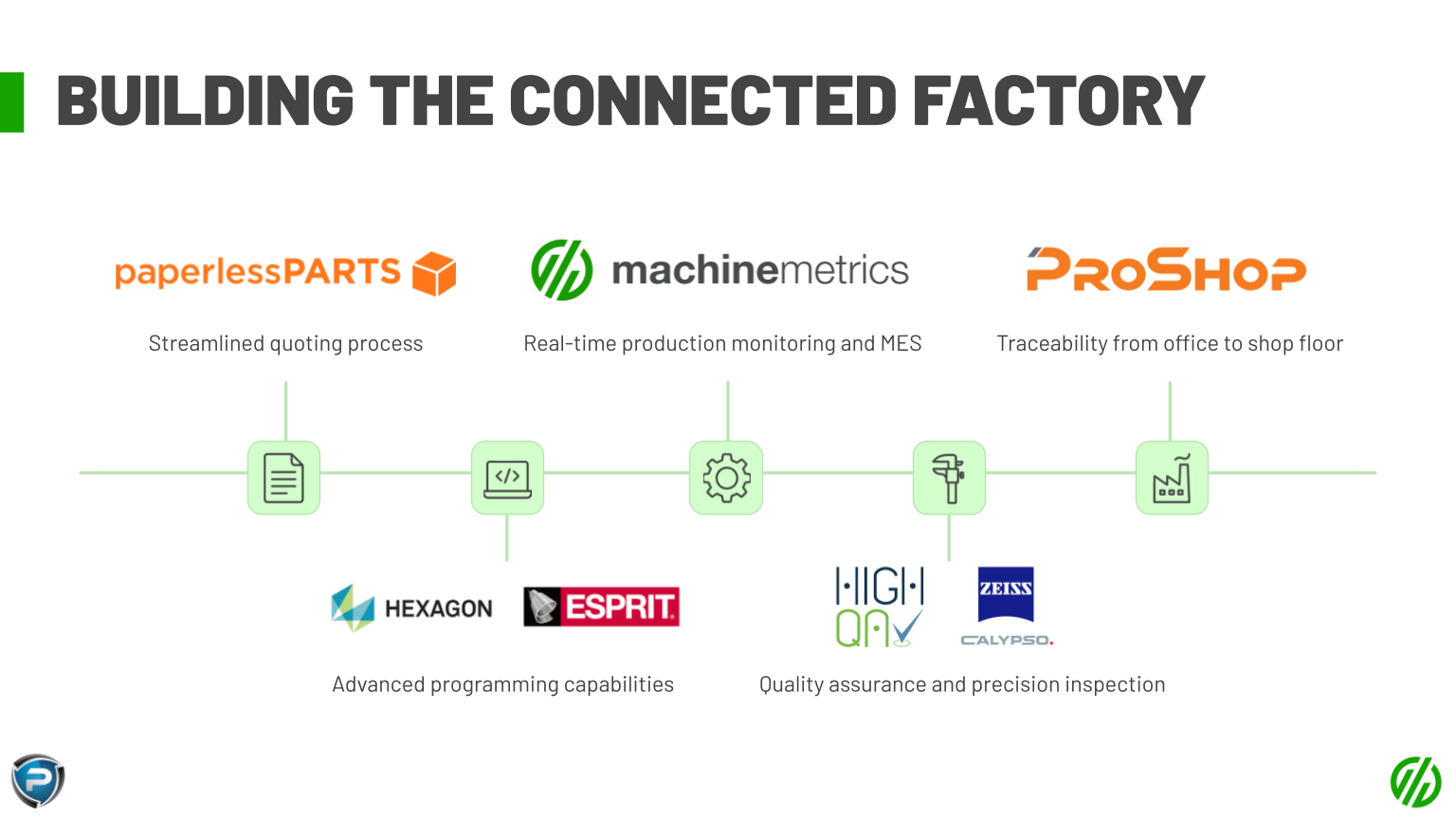

The democratization of manufacturing data will undoubtedly change the manufacturing landscape forever. In 2020, about 60% of global manufacturing companies will use connected device data for analysis (Deloitte, 2019), which is evidence that IoT is already driving unprecedented disruption in what we know is a notoriously slow-adoption industry. IoT technology is already transforming traditional manufacturing supply chains into dynamic, interconnected data systems that affect every stakeholder within the manufacturing lifecycle.

From small, medium and large manufacturers; operations, supply chain and IT leadership; operators and engineers; IT and OT system integrators; platform and software vendors; equipment builders; research, education and training, everyone stands to gain from these new technologies and data-driven insights. Legacy business and operational structures will transform into horizontal, flexible, and agile business opportunities more readily capable of being a part of a connected partnership ecosystem. This newfound ability to focus on what everyone does best will reveal opportunities for a more sustainable industrial economy.

Of course, data democratization is a tremendous challenge as we’ve learned, but, if leveraged properly, the opportunities for continuous improvement for all manufacturing lifecycle members will be far greater than ever before.

Don’t just take our word for it: go check out the report at www.machinemetrics.com/stateoftheindustry2019 and, when you do, try to think about this: how will you use data to improve your business in 2020?

View the full State of the Industry Report HERE!

.png?width=1960&height=1300&name=01_comp_Downtime-%26-Quality_laptop%20(1).png)

Comments